Did you know that day trading can be more taxing than a surprise visit from your in-laws? Understanding the tax implications of day trading ETFs is crucial for maximizing your profits and minimizing your liabilities. This article dives deep into how profits are taxed, the capital gains rates, and the deductibility of losses. We’ll also explore the wash sale rule, necessary tax forms, and the impact of short-term trading on your tax situation. Plus, find out how to leverage tax strategies and the benefits of trading ETFs, including retirement account options. Whether you're curious about state taxes or tax-loss harvesting, we’ve got you covered. Join DayTradingBusiness as we break it all down for you!

What are the tax implications of day trading ETFs?

Day trading ETFs can have significant tax implications. Profits from day trading are typically considered short-term capital gains, taxed at your ordinary income tax rate. If you hold an ETF for less than a year before selling, these gains will be taxed more heavily than long-term capital gains. Additionally, frequent trading may trigger wash sale rules, which could disallow some losses for tax purposes. Keep track of your trades and consult a tax professional for personalized advice.

How are profits from day trading ETFs taxed?

Profits from day trading ETFs are taxed as short-term capital gains. This means they are taxed at your ordinary income tax rate, which can range from 10% to 37% depending on your income level. You’ll report these gains on your tax return, typically using Schedule D and Form 8949. Keep in mind that if you’re classified as a trader by the IRS, you might qualify for different tax treatments. Always consider consulting a tax professional to understand your specific situation.

What is the capital gains tax rate for day trading ETFs?

The capital gains tax rate for day trading ETFs is typically the short-term capital gains rate, which is the same as your ordinary income tax rate. If you hold an ETF for one year or less before selling, profits are taxed at this higher rate. Long-term capital gains apply only if you hold the ETF for more than a year, resulting in a lower tax rate. Always consider your specific income level, as it affects the exact percentage.

Are day trading losses on ETFs tax-deductible?

Yes, day trading losses on ETFs are tax-deductible. You can use these losses to offset any capital gains you’ve made during the year. If your losses exceed your gains, you can deduct up to $3,000 against your ordinary income and carry forward any remaining losses to future years. Make sure to keep accurate records of your trades for tax reporting.

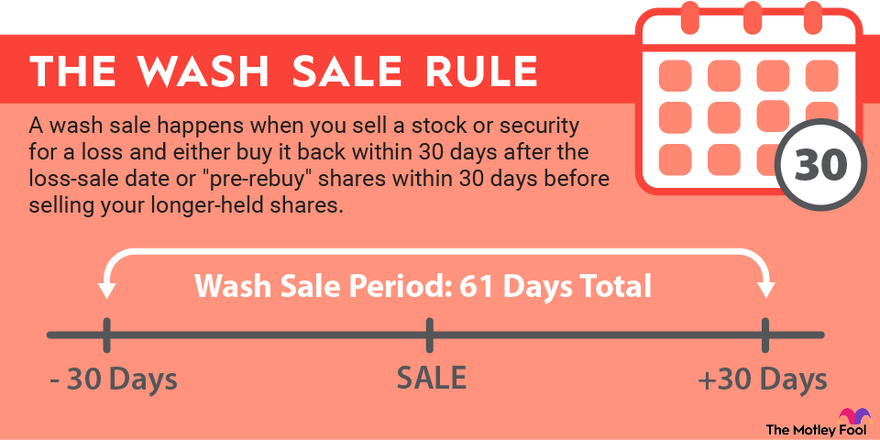

How does the wash sale rule affect day trading ETFs?

The wash sale rule impacts day trading ETFs by disallowing the deduction of losses if you repurchase the same or substantially identical ETF within 30 days. This means if you sell an ETF at a loss and buy it back shortly after, that loss can't be claimed on your taxes, potentially increasing your tax liability. Day traders need to be mindful of this rule to avoid unexpected tax consequences.

What tax forms do I need for day trading ETFs?

For day trading ETFs, you'll typically need the following tax forms:

1. Form 1099-B: Reports your sales of securities. You'll get this from your broker.

2. Schedule D: Used to summarize your capital gains and losses.

3. Form 8949: Details each transaction, including the date, proceeds, cost basis, and gain or loss.

Make sure to keep accurate records of all trades for reporting.

How does short-term trading impact my tax liability?

Short-term trading, including day trading ETFs, typically results in higher tax liability due to short-term capital gains. These gains are taxed as ordinary income, which can push you into a higher tax bracket. If you hold an ETF for less than a year before selling, you’ll pay these rates on any profits, unlike long-term capital gains, which are usually taxed at lower rates. Additionally, frequent trading can complicate your tax situation, leading to more paperwork and potential for errors in reporting. Always consider consulting a tax professional for personalized advice.

Do I have to report every trade I make with ETFs?

Yes, you must report every trade you make with ETFs for tax purposes. Each trade is considered a taxable event, and you need to report any gains or losses on your tax return. Keep detailed records of all transactions to accurately calculate your capital gains and losses.

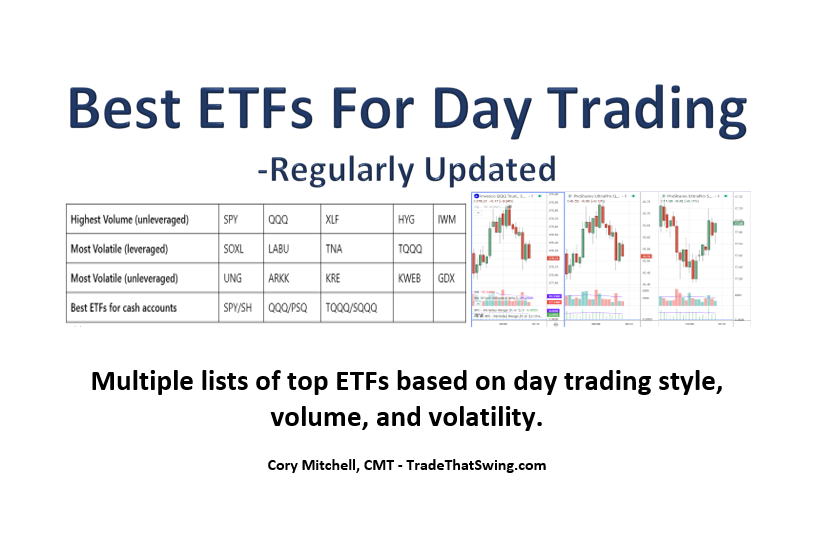

What Are the Best ETFs for Day Trading and Their Tax Implications?

The best ETFs for day trading typically include those with high liquidity and low expense ratios, such as SPDR S&P 500 ETF (SPY), Invesco QQQ Trust (QQQ), and iShares Russell 2000 ETF (IWM).

Tax implications of day trading ETFs include being subject to short-term capital gains tax on profits, which is taxed at ordinary income rates. Additionally, wash sale rules may apply if you sell and repurchase the same ETF within 30 days.

Learn more about: What Are the Best ETFs for Day Trading?

What are the tax benefits of using an ETF for day trading?

Using an ETF for day trading offers several tax benefits. First, ETFs typically generate fewer capital gains distributions compared to mutual funds, which can minimize your tax liability. Second, if you hold an ETF for more than one year, you qualify for long-term capital gains rates, which are lower than short-term rates. Third, losses from day trading ETFs can offset gains, reducing your overall taxable income. Additionally, using a tax-advantaged account like an IRA for trading ETFs can further defer taxes.

How can I minimize taxes on my day trading profits?

To minimize taxes on your day trading profits from ETFs, consider these strategies:

1. Hold ETFs for Longer: If you hold your ETFs for over a year, you can benefit from lower long-term capital gains tax rates.

2. Offset Gains with Losses: Use tax-loss harvesting to sell underperforming ETFs. This can offset your short-term gains and reduce your taxable income.

3. Utilize Tax-Advantaged Accounts: Trade within tax-advantaged accounts like IRAs or 401(k)s to defer taxes on gains.

4. Keep Accurate Records: Maintain detailed records of all trades to ensure accurate reporting and take advantage of all deductible expenses.

5. Consult a Tax Professional: A tax advisor can help you navigate complex tax rules and identify specific strategies for your situation.

Implementing these tactics can help you effectively manage and minimize your tax burden on day trading profits.

Are there specific tax strategies for day trading ETFs?

Yes, there are specific tax strategies for day trading ETFs.

1. Short-term Capital Gains: Since day trading typically involves holding ETFs for less than a year, you'll incur short-term capital gains, taxed at your ordinary income rate.

2. Wash Sale Rule: Be aware of the wash sale rule, which can disallow losses if you buy the same ETF within 30 days before or after selling it at a loss.

3. Tax Loss Harvesting: Utilize tax loss harvesting to offset gains by selling underperforming ETFs.

4. Retirement Accounts: Consider trading within tax-advantaged accounts like IRAs, where gains can grow tax-free or tax-deferred.

5. Record Keeping: Keep detailed records of all trades to accurately report gains and losses.

Implementing these strategies can help minimize your tax liability when day trading ETFs.

What is the difference between realized and unrealized gains in ETF trading?

Realized gains in ETF trading occur when you sell your ETFs for more than you paid, triggering a taxable event. Unrealized gains, on the other hand, represent the increase in value of ETFs you still hold; these are not taxed until you sell. Tax implications for realized gains can affect your tax bracket and may require you to pay capital gains tax, while unrealized gains do not impact your taxes until the sale.

How do state taxes affect day trading of ETFs?

State taxes can significantly impact day trading of ETFs by adding an extra layer of expense to your trading profits. Many states tax capital gains, which includes profits from day trading. Depending on your state, these taxes can range from 0% to over 13%.

If you frequently buy and sell ETFs, you'll need to consider how your state's tax rate affects your net returns. Some states, like Florida and Texas, have no state income tax, making them more favorable for day traders. Conversely, states with high capital gains taxes can diminish your profits, especially if you're making many trades. Always factor in these taxes when calculating your overall profitability from day trading ETFs.

Learn about How to Choose Day Trading ETFs?

Can retirement accounts be used for day trading ETFs tax-free?

Yes, retirement accounts like IRAs and 401(k)s can be used for day trading ETFs tax-free. Gains and losses in these accounts are not taxed until withdrawal, allowing for tax-free growth. However, be aware of potential penalties for early withdrawals and the rules specific to your retirement account type.

What should I know about tax-loss harvesting in day trading ETFs?

Tax-loss harvesting in day trading ETFs allows you to offset capital gains by selling underperforming ETFs at a loss. This strategy can reduce your overall tax liability. Be aware of the wash-sale rule; if you repurchase the same ETF within 30 days, the loss is disallowed for tax purposes. Keep detailed records of transactions to track gains and losses accurately. It's crucial to consult a tax professional for personalized advice.

How do different countries tax day trading ETFs?

Countries tax day trading ETFs differently based on their regulations. In the U.S., short-term capital gains from day trading ETFs are taxed as ordinary income. In Canada, profits are treated as capital gains, with only 50% being taxable. The UK taxes profits as capital gains, but day trading can be taxed as income if viewed as a business activity. In Australia, profits from day trading ETFs are also considered capital gains, and the tax rate depends on how long the ETFs were held. Always check local tax laws for specific rates and regulations.

Learn about How to Choose Day Trading ETFs?

Conclusion about Tax Implications of Day Trading ETFs

Understanding the tax implications of day trading ETFs is crucial for maximizing your profits and minimizing liabilities. Profits are typically taxed as short-term capital gains, while losses may be deductible under certain conditions. Be mindful of the wash sale rule, and ensure you report every trade accurately to avoid issues with tax authorities. Utilizing effective tax strategies can help mitigate your tax burden, especially when considering state taxes and the benefits of retirement accounts. By staying informed and planning accordingly, you can navigate the complexities of ETF trading taxes. For more detailed insights and assistance, explore resources from DayTradingBusiness.

Learn about Tax Implications of Forex Day Trading