Did you know that a recent study found that traders are more likely to make irrational decisions when they haven't had their morning coffee? In the world of day trading, psychology plays a crucial role in determining success. This article dives into the complex relationship between emotions and trading, highlighting key challenges such as fear, greed, and anxiety. Discover effective techniques for emotional regulation, the importance of discipline, and the benefits of mindfulness. Learn how to build resilience, utilize visualization, and maintain a trading journal to enhance your performance. With insights from DayTradingBusiness, you’ll find strategies to develop a positive mindset and create a balanced routine, ensuring that your emotions work for you, not against you.

How Does Psychology Impact Day Trading Success?

Psychology significantly impacts day trading success by influencing decision-making and emotional control. Traders who manage their emotions effectively can avoid impulsive decisions driven by fear or greed. Maintaining discipline helps in sticking to trading plans and strategies, reducing the likelihood of costly mistakes. A positive mindset fosters resilience, allowing traders to recover from losses and stay focused on long-term goals. Conversely, poor psychological management can lead to overtrading, stress, and burnout, undermining overall performance. Developing emotional intelligence and self-awareness is crucial for sustaining success in day trading.

What Are Common Emotional Challenges in Day Trading?

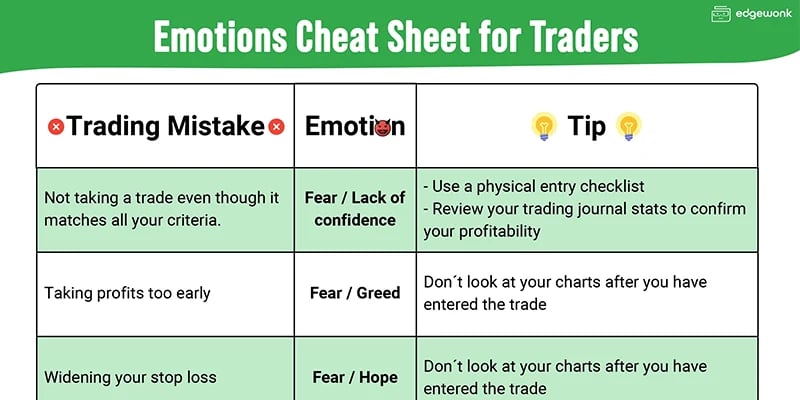

Common emotional challenges in day trading include fear of missing out (FOMO), anxiety over losses, greed during winning streaks, and frustration with market fluctuations. Traders often struggle with maintaining discipline, leading to impulsive decisions. Overconfidence can cause traders to take excessive risks, while self-doubt may paralyze their ability to act. Managing these emotions is crucial for consistent success in day trading.

How Can I Control Fear While Day Trading?

To control fear while day trading, establish a solid trading plan with clear entry and exit points. Practice risk management by only risking a small percentage of your capital on each trade. Use stop-loss orders to limit losses and protect your investment. Stay informed but avoid overloading on information, which can heighten anxiety. Regularly review your trades to learn from mistakes and build confidence. Finally, take breaks to clear your mind and maintain a balanced perspective.

What Techniques Help Manage Greed in Trading?

1. Set Clear Goals: Define specific profit targets and stick to them.

2. Use Stop-Loss Orders: Protect your capital by setting limits on losses.

3. Practice Discipline: Follow your trading plan consistently, avoiding impulsive decisions.

4. Limit Position Size: Control risk by not overinvesting in any single trade.

5. Take Breaks: Step away after a series of trades to reset your mindset.

6. Journal Your Trades: Record emotions and decisions to identify patterns of greed.

7. Focus on Process, Not Profit: Concentrate on executing your strategy rather than the money.

8. Stay Informed: Educate yourself continuously to build confidence and reduce fear of missing out.

9. Seek Accountability: Share your trading goals with a mentor or peer for support.

10. Reflect Regularly: Analyze your performance to understand when greed affects your decisions.

How Do I Overcome Anxiety in Day Trading?

To overcome anxiety in day trading, start by setting clear goals and limits for each trading session. Develop a solid trading plan and stick to it; this reduces uncertainty and boosts confidence. Practice mindfulness techniques, like deep breathing or short meditation, to stay focused and calm during trades. Keep a trading journal to reflect on your decisions and emotions, which helps identify patterns and triggers. Lastly, take breaks when needed to prevent burnout and maintain a fresh perspective.

What Role Does Discipline Play in Day Trading Psychology?

Discipline is crucial in day trading psychology. It helps traders stick to their strategies, manage risk, and avoid emotional decisions. A disciplined approach minimizes impulsive trading and fosters patience, allowing traders to wait for optimal setups. By maintaining discipline, traders can effectively control fear and greed, leading to more consistent performance and better overall results.

How Can Mindfulness Improve Day Trading Performance?

Mindfulness can enhance day trading performance by helping traders manage emotions like fear and greed. It promotes awareness of thoughts and feelings, allowing traders to make more rational decisions. By staying present, traders can recognize impulsive behaviors and avoid emotional trading. Mindfulness techniques, such as meditation, can reduce stress and improve focus, leading to clearer analysis of market trends. Ultimately, this mental clarity helps in sticking to trading plans and maintaining discipline, which is crucial for success in day trading.

What Are Effective Strategies for Emotional Regulation in Trading?

1. Set Clear Goals: Define your trading objectives to maintain focus and reduce emotional decision-making.

2. Practice Mindfulness: Use techniques like meditation or deep breathing to stay present and calm during trading sessions.

3. Develop a Trading Plan: Create a structured plan with entry and exit strategies to minimize impulsive reactions.

4. Limit Exposure: Set a maximum loss limit to prevent emotional distress from significant losses.

5. Take Breaks: Step away from the screen after a loss or a series of trades to regain perspective and avoid rash decisions.

6. Reflect on Trades: Keep a trading journal to analyze your emotions and decisions, helping you learn and improve.

7. Use Visualization: Imagine successful trades to build confidence and reduce anxiety during live trading.

8. Maintain a Routine: Establish a consistent daily routine to create stability and reduce emotional fluctuations.

How Can I Build Resilience as a Day Trader?

To build resilience as a day trader, focus on developing a strong mindset. Start by setting clear goals and maintaining a trading journal to track your decisions and emotions. Practice mindfulness techniques to stay calm during volatile market conditions. Embrace losses as learning opportunities rather than failures. Establish a routine that includes regular breaks to prevent burnout. Surround yourself with a supportive community of traders to share experiences and advice. Finally, continuously educate yourself about market trends and psychological strategies to enhance your trading skills.

What Is the Importance of a Trading Journal for Emotions?

A trading journal is crucial for managing emotions in day trading. It helps you track your trades, decisions, and emotional responses, allowing you to identify patterns in your behavior. By reviewing your entries, you can pinpoint emotional triggers that lead to poor decision-making. This self-awareness fosters discipline, enabling you to stick to your trading plan and reduce impulsive actions. Ultimately, a trading journal serves as a powerful tool for emotional regulation, improving your overall trading performance.

How Can Visualization Techniques Aid in Day Trading?

Visualization techniques can significantly enhance day trading by helping traders manage their emotions and improve decision-making. By mentally rehearsing trading scenarios, you can build confidence and reduce anxiety. Visualizing successful trades reinforces positive outcomes, making it easier to stick to your strategy during volatile markets. Additionally, envisioning potential losses prepares you emotionally, allowing for better risk management. This mental practice cultivates a disciplined mindset, essential for navigating the fast-paced world of day trading.

## What Are Key Psychological Strategies for Successful Day Trading?

Day trading is the practice of buying and selling financial instruments within a single trading day to capitalize on short-term price movements. It involves executing multiple trades to profit from small fluctuations in price. Effective day trading requires a solid understanding of market trends, technical analysis, and risk management strategies.

Learn more about: What is Day Trading?

What Are the Signs of Emotional Trading?

Signs of emotional trading include making impulsive decisions based on fear or greed, frequently checking stock prices, overreacting to market news, holding losing positions too long, and avoiding trades out of anxiety. You might also experience significant stress after losses or feel overly excited after wins, leading to reckless behavior. If you find yourself deviating from your trading plan or constantly justifying your trades emotionally, you're likely experiencing emotional trading.

How Do I Develop a Positive Trading Mindset?

To develop a positive trading mindset, start by setting clear goals and maintaining realistic expectations. Practice emotional awareness; recognize when fear or greed influences your decisions. Create a trading plan and stick to it, which helps reduce impulsive actions. Use journaling to track your trades and emotions, allowing you to learn from mistakes. Surround yourself with a supportive community or mentor to share experiences and strategies. Lastly, practice mindfulness or meditation to enhance focus and reduce stress.

What Impact Does Stress Have on Day Trading Decisions?

Stress negatively impacts day trading decisions by clouding judgment and increasing impulsivity. When stressed, traders may overreact to market fluctuations, leading to poor choices like chasing losses or deviating from strategies. High stress can also impair focus, causing missed opportunities or errors in analysis. Managing emotions through practices like mindfulness or taking breaks is crucial for maintaining clear decision-making and achieving consistent results in day trading.

How Can I Create a Balanced Trading Routine to Manage Emotions?

To create a balanced trading routine that helps manage emotions, start by setting specific trading hours. Stick to a consistent schedule to build discipline. Incorporate regular breaks to avoid burnout and maintain focus.

Develop a pre-trading checklist to prepare mentally and reduce impulsive decisions. Use journaling to reflect on trades, noting emotional responses to identify patterns.

Limit news consumption during trading to minimize anxiety and distractions. Set clear goals and risk parameters for each trade to foster confidence.

Practice mindfulness techniques like deep breathing or meditation before trading to enhance emotional control. Finally, review and adjust your routine regularly based on your emotional state and trading performance.

What Resources Are Available for Improving Trading Psychology?

To improve trading psychology and manage your emotions in day trading, consider these resources:

1. Books: "The Psychology of Trading" by Brett Steenbarger and "Trading in the Zone" by Mark Douglas offer insights into emotional management.

2. Online Courses: Platforms like Udemy or Coursera have courses focused on trading psychology.

3. Podcasts: Listen to trading psychology-focused podcasts such as "The Trading Coach" or "Chat with Traders" for expert advice.

4. Forums and Communities: Engage with trading communities on Reddit or Elite Trader to share experiences and strategies.

5. Journaling Tools: Use trading journals like Edgewonk to track your emotions and decisions.

6. Meditation Apps: Apps like Headspace or Calm can help you develop mindfulness and reduce stress.

7. Therapists or Coaches: Consider working with a sports psychologist or trading coach specializing in mental resilience.

Utilize these resources to enhance your trading mindset and emotional control.

Conclusion about Day Trading Psychology: Managing Your Emotions

In conclusion, mastering day trading psychology is crucial for achieving success in the market. By understanding the emotional challenges and implementing strategies to manage fear, greed, and anxiety, traders can enhance their performance and decision-making. Cultivating discipline, mindfulness, and resilience, along with maintaining a trading journal, can significantly improve emotional regulation. For further guidance and resources tailored to your trading journey, DayTradingBusiness is here to support you in developing a strong psychological foundation.

Learn about Tips for Managing Emotions in Futures Day Trading