Did you know that the term "HODL," originally a typo, has become a rallying cry for crypto enthusiasts? In the unpredictable world of cryptocurrency, understanding market cycles is crucial for successful day trading. This article dives into the key phases of crypto market cycles, explores how to identify bull and bear markets, and discusses the importance of historical data and technical analysis. We’ll cover the best timeframes for trading, common pitfalls to avoid, and effective risk management strategies. Additionally, we’ll highlight the impact of market sentiment, macroeconomic factors, and psychological influences on trading decisions. With insights and resources from DayTradingBusiness, you'll be equipped to navigate the volatile crypto landscape like a pro.

What are the key phases of crypto market cycles for day trading?

The key phases of crypto market cycles for day trading are:

1. Accumulation: Traders buy assets at low prices when sentiment is bearish, anticipating future growth.

2. Markup: Prices rise as demand increases, attracting more traders. This phase offers opportunities for short-term gains.

3. Distribution: Prices peak, and savvy traders sell to maximize profits. This phase often sees increased volatility.

4. Markdown: Prices decline as selling pressure mounts, leading to panic selling. Day traders may look for short positions or wait for the next accumulation phase.

Understanding these phases helps in making informed trading decisions and timing entries and exits effectively.

How can I identify a crypto bull market cycle?

To identify a crypto bull market cycle, look for these key indicators:

1. Price Trends: Consistent upward price movements over weeks or months.

2. Volume Increase: Rising trading volume alongside price increases indicates strong interest.

3. Market Sentiment: Positive news, social media buzz, and overall optimism in the crypto community.

4. Technical Indicators: Use moving averages; a bullish crossover (short-term MA crossing above long-term MA) is a strong signal.

5. Market Dominance: Bitcoin's dominance declining while altcoins gain traction often signals a bull market.

6. Institutional Investment: Increased investment from institutions typically signals confidence in the market.

Monitor these factors to spot a bull market cycle effectively.

What indicators signal a bear market in cryptocurrency?

Indicators that signal a bear market in cryptocurrency include:

1. Declining Prices: A consistent drop in prices over an extended period, typically 20% or more from recent highs.

2. Decreased Trading Volume: A significant drop in trading volume can indicate waning interest and confidence.

3. Negative Market Sentiment: Increased fear or pessimism in the market, often reflected in social media and news.

4. Rising Correlation with Traditional Markets: If cryptocurrencies start to move in tandem with declining stock markets, it may signal a broader economic downturn.

5. Failure to Break Resistance Levels: When prices repeatedly fail to break through established resistance levels, it may indicate weakness.

6. Increased Short Selling: A rise in short positions can suggest that traders expect further price declines.

Monitoring these indicators can help day traders evaluate potential bear market conditions.

How do I use historical data to evaluate crypto market cycles?

To evaluate crypto market cycles using historical data, follow these steps:

1. Gather Data: Collect historical price data for the cryptocurrencies you’re interested in, focusing on daily, weekly, and monthly charts.

2. Identify Patterns: Look for recurring patterns in price movements, such as bullish and bearish cycles, using indicators like moving averages and RSI.

3. Analyze Volume: Examine trading volume during different phases of the market cycle to gauge market interest and potential reversals.

4. Use Technical Analysis: Apply technical analysis tools like Fibonacci retracement and trend lines to pinpoint support and resistance levels.

5. Check News Correlation: Correlate price movements with historical news events to see how external factors influenced market cycles.

6. Backtest Strategies: Use historical data to backtest your trading strategies, assessing their effectiveness during different market conditions.

7. Monitor Sentiment: Analyze sentiment indicators to understand market psychology during various phases of the cycle.

By combining these methods, you can effectively evaluate crypto market cycles and make informed day trading decisions.

What role do market sentiment and news play in crypto cycles?

Market sentiment and news significantly influence crypto cycles by driving investor behavior and price movements. Positive news, like regulatory approval or institutional investment, can create bullish sentiment, leading to price surges. Conversely, negative news, such as security breaches or regulatory crackdowns, often triggers panic selling and bearish trends. Day traders must monitor sentiment indicators, social media trends, and news outlets to anticipate market shifts and capitalize on price fluctuations. Understanding this interplay helps in making informed trading decisions.

How can technical analysis help in understanding market cycles?

Technical analysis helps in understanding crypto market cycles by identifying patterns, trends, and key price levels. By analyzing historical price charts, traders can spot recurring cycles like bull and bear markets. Indicators such as moving averages, RSI, and MACD provide insights into momentum and potential reversals. Recognizing these cycles enables traders to make informed decisions, time their entries and exits, and manage risk effectively. Understanding market sentiment through volume analysis also enhances cycle evaluation, allowing for better predictions of future price movements.

What are the best timeframes for day trading in crypto markets?

The best timeframes for day trading in crypto markets typically range from 1 minute to 15 minutes. Many traders prefer the 5-minute chart for capturing quick price movements while balancing noise. The 15-minute chart can help identify trends and potential reversals. It's crucial to adapt your strategy based on market volatility and liquidity, as these can influence your trading decisions significantly.

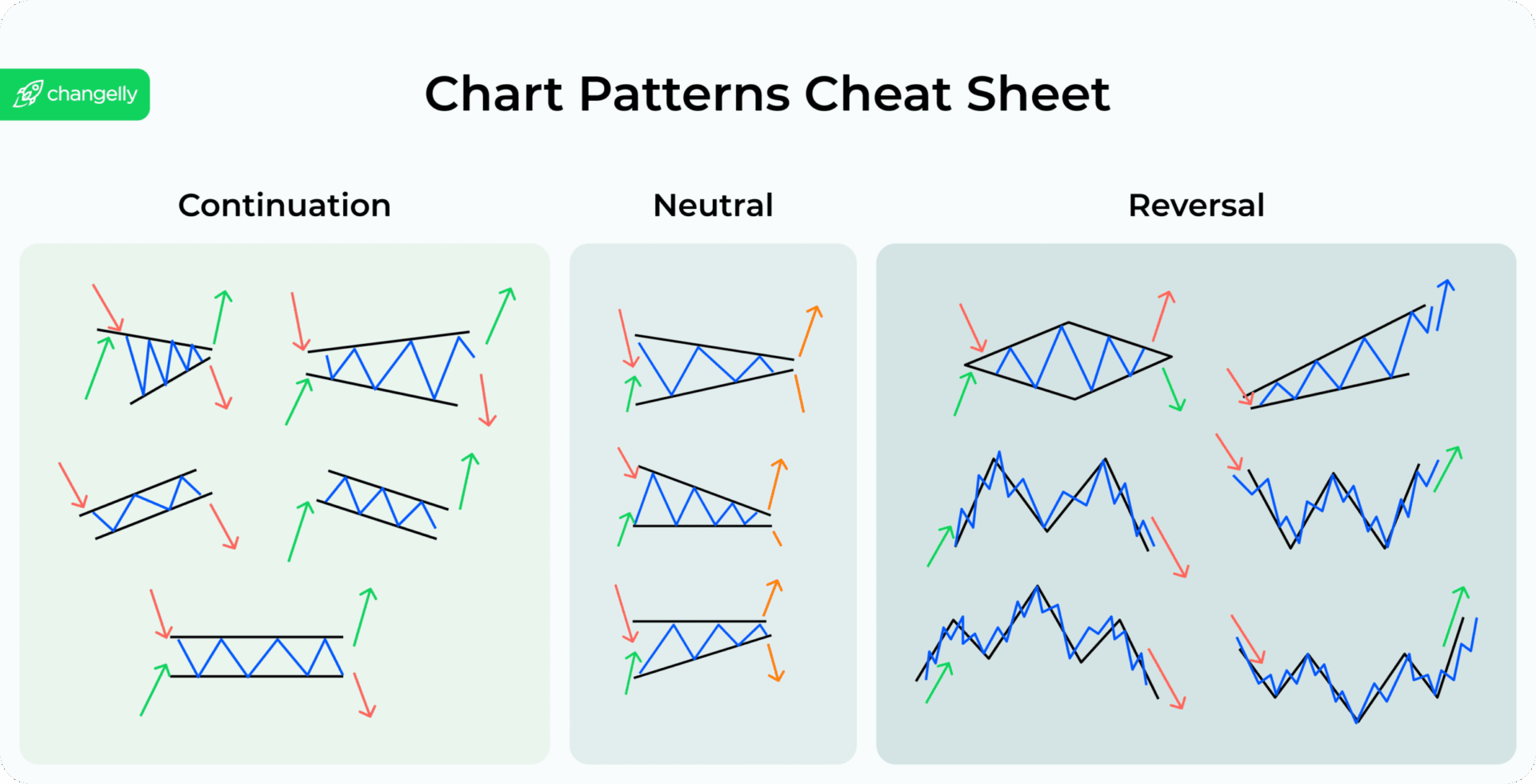

How do I spot reversal patterns in crypto market cycles?

To spot reversal patterns in crypto market cycles, look for key formations like head and shoulders, double tops/bottoms, and bullish or bearish flags. Monitor volume changes; increased volume during a pattern can signal a stronger reversal. Use candlestick patterns, such as doji or engulfing candles, to identify potential reversals. Analyze support and resistance levels; price bouncing off these areas may indicate a reversal. Finally, incorporate indicators like the Relative Strength Index (RSI) to detect overbought or oversold conditions that often precede reversals.

How Can I Choose the Best Crypto Markets for Day Trading by Evaluating Market Cycles?

To choose the best crypto markets for day trading, evaluate market cycles by analyzing price trends, volatility, and trading volume. Look for markets with consistent upward or downward trends, as well as those with high liquidity to facilitate quick trades. Monitor news and market sentiment to anticipate potential shifts. Use technical analysis tools like moving averages and RSI to identify entry and exit points. Finally, consider the overall market cap and the specific coin's performance relative to Bitcoin for better trade opportunities.

Learn more about: How to Choose the Best Crypto Markets for Day Trading

What are common mistakes to avoid when trading during market cycles?

1. Ignoring market trends: Always analyze whether the market is in a bullish or bearish cycle before making trades.

2. Overtrading: Resist the urge to make frequent trades based on short-term fluctuations; focus on quality over quantity.

3. Lack of risk management: Set stop-loss orders to protect your investment and avoid emotional decision-making.

4. Following the herd: Don’t blindly follow popular sentiment; conduct your own research to make informed trades.

5. Neglecting fundamentals: Understand the underlying factors driving price changes, not just technical indicators.

6. Timing the market: Trying to perfectly time entries and exits often leads to losses; establish a consistent trading strategy.

7. Ignoring liquidity: Trade assets with sufficient liquidity to avoid slippage and ensure better execution prices.

8. Failing to adapt: Be flexible and adjust your strategy as market conditions change; rigidity can lead to missed opportunities.

Learn about Common Mistakes in Day Trading Scalping and How to Avoid Them

How can I manage risk effectively during crypto market fluctuations?

To manage risk during crypto market fluctuations, follow these strategies:

1. Set Stop-Loss Orders: Automatically sell assets at a predetermined price to limit losses.

2. Diversify Your Portfolio: Spread investments across different cryptocurrencies to reduce exposure.

3. Use Position Sizing: Only invest a small percentage of your capital in any single trade to mitigate risk.

4. Stay Informed: Monitor market news and trends to anticipate fluctuations and adjust your strategy.

5. Avoid Emotional Trading: Stick to your trading plan and avoid impulsive decisions based on market hype.

6. Implement Risk-Reward Ratios: Aim for trades with a favorable risk-reward ratio, typically at least 1:2.

7. Regularly Reassess Your Strategy: Continuously evaluate your trading approach based on market conditions.

These steps will help you navigate the volatile crypto market and protect your investments.

What tools and platforms are best for tracking crypto market cycles?

The best tools for tracking crypto market cycles include:

1. CoinMarketCap – Offers comprehensive price tracking and market cap data.

2. TradingView – Provides advanced charting tools and community-driven insights.

3. Glassnode – Analyzes on-chain data to show market trends and investor behavior.

4. CryptoQuant – Offers market analytics and metrics for timely trading decisions.

5. Messari – Provides in-depth research and real-time data on various cryptocurrencies.

These platforms help day traders identify trends, monitor price movements, and make informed decisions.

How do macroeconomic factors influence crypto market cycles?

Macroeconomic factors like interest rates, inflation, and economic growth significantly influence crypto market cycles. For instance, rising interest rates typically lead to decreased liquidity, which can drive down crypto prices as investors seek safer assets. Inflation can push investors towards cryptocurrencies as a hedge, potentially increasing demand and prices. Economic downturns often result in risk aversion, causing a sell-off in crypto markets. Monitoring these factors helps day traders anticipate market movements and adjust their strategies accordingly.

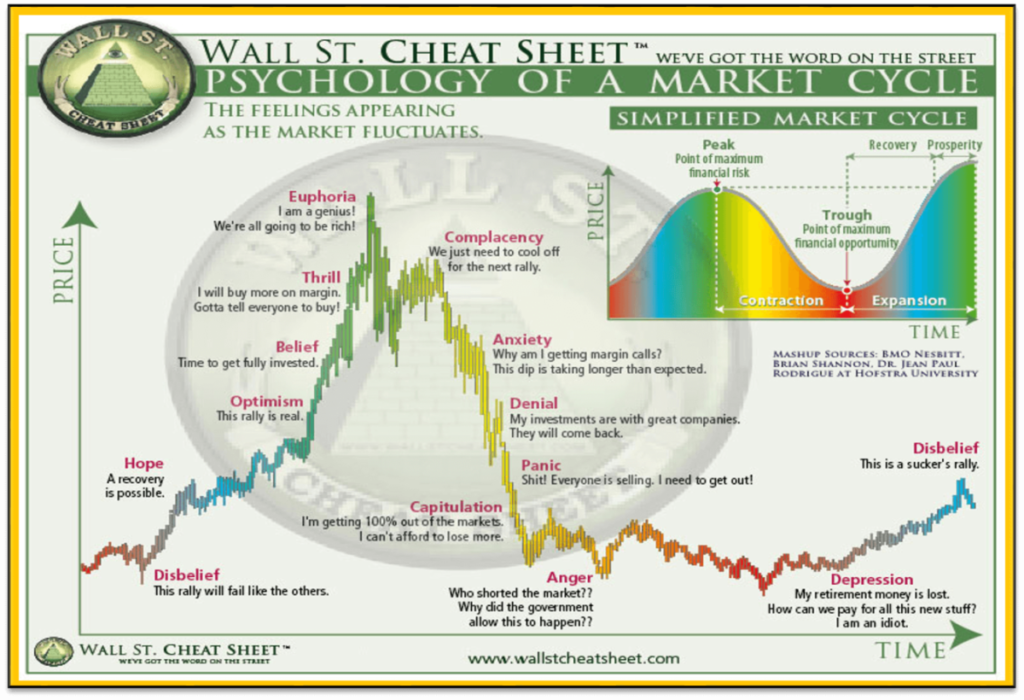

What are the psychological factors affecting traders in market cycles?

Psychological factors affecting traders in market cycles include fear and greed, which drive decision-making during bullish and bearish trends. Confirmation bias leads traders to seek information that supports their existing beliefs, often ignoring contrary data. Overconfidence can cause traders to underestimate risks, leading to poor choices. Loss aversion makes traders hold onto losing positions too long, while the desire for quick gains can prompt impulsive trades. Social influence, such as following trends or advice from others, can also skew judgment. Understanding these factors is crucial for effective day trading in crypto markets.

How can I develop a strategy for day trading based on market cycles?

To develop a day trading strategy based on crypto market cycles, start by identifying the current market cycle—whether it's accumulation, uptrend, distribution, or downtrend. Analyze historical price patterns and volume trends to spot cyclical behaviors. Use technical indicators like moving averages and RSI to confirm trends. Set clear entry and exit points based on support and resistance levels within the cycle. Monitor news and sentiment, as they can trigger rapid changes. Finally, backtest your strategy with historical data to refine it before trading live.

Learn about How to Develop Your Own Scalping Strategy for Day Trading

What resources can help me learn more about crypto market cycles?

To learn about crypto market cycles for day trading, check out these resources:

1. Books: "The Basics of Bitcoins and Blockchains" by Antony Lewis offers insights into market behavior.

2. Online Courses: Platforms like Udemy and Coursera have courses specifically on crypto trading strategies and market analysis.

3. YouTube Channels: Follow channels like DataDash and Coin Bureau for practical analysis and cycle explanations.

4. Websites: CoinMarketCap and CryptoCompare provide data and historical charts to analyze market trends.

5. Social Media: Join Twitter communities and Reddit threads focused on crypto trading for real-time insights and discussions.

Engaging with these resources will enhance your understanding of crypto market cycles.

How do I measure the volatility of cryptocurrencies during different cycles?

To measure the volatility of cryptocurrencies during different market cycles, follow these steps:

1. Historical Price Data: Collect historical price data for the cryptocurrency over various time frames (daily, weekly, monthly).

2. Calculate Standard Deviation: Use standard deviation to quantify price fluctuations. A higher standard deviation indicates greater volatility.

3. Average True Range (ATR): Calculate the ATR to gauge price movement over a specific period. This helps identify volatility trends.

4. Bollinger Bands: Apply Bollinger Bands to visualize price volatility. The width of the bands indicates volatility levels.

5. Volume Analysis: Monitor trading volume alongside price changes. Increased volume during price swings often signals higher volatility.

6. Market Sentiment: Analyze news, social media, and sentiment indicators. Market sentiment can drive volatility significantly.

7. Cycle Identification: Recognize market cycles (bull, bear, and consolidation) to contextualize volatility. Different cycles exhibit varying volatility patterns.

Using these methods will provide a comprehensive view of cryptocurrency volatility across market cycles, aiding in day trading decisions.

Conclusion about Evaluating Crypto Market Cycles for Day Trading

Understanding crypto market cycles is essential for successful day trading. By identifying key phases, recognizing indicators of bull and bear markets, and leveraging historical data, traders can make informed decisions. Market sentiment, technical analysis, and effective risk management play crucial roles in navigating these cycles. To enhance your trading strategy, utilize the right tools and stay informed about macroeconomic factors and psychological influences. Ultimately, a well-rounded approach will empower you to capitalize on opportunities within the dynamic cryptocurrency landscape. For further insights and resources, consider exploring the expertise offered by DayTradingBusiness.

Learn about How to Stay Updated on Crypto Market News for Day Trading