Did you know that over 90% of day traders lose money, yet they keep coming back like moths to a flame? In the ever-evolving landscape of crypto trading, understanding the future of the markets is crucial for success. This article explores key themes such as the impact of regulatory changes on day trading, emerging trends shaping the crypto environment, and the best cryptocurrencies to trade in 2024. We’ll also delve into essential trading tools, the influence of market sentiment, and the risks associated with crypto trading. Additionally, learn how to adapt to volatility, utilize technical analysis, and choose the best platforms for trading. Don’t miss insights on liquidity, social media's role, emotional management, and the tax implications of your trades. Lastly, discover how AI is transforming the trading landscape and strategies for navigating bear markets. With all this knowledge, DayTradingBusiness is here to help you thrive in the crypto market.

How Will Regulatory Changes Impact Day Trading in Crypto?

Regulatory changes will likely increase compliance costs for crypto exchanges, which could lead to fewer platforms offering day trading. Stricter rules may also enhance market stability, making price movements less volatile but potentially reducing profit opportunities for day traders. Additionally, clearer regulations could attract institutional investors, increasing liquidity but also intensifying competition. Overall, day traders may need to adapt their strategies to navigate a more regulated environment, focusing on compliance and risk management.

What Are the Key Trends Shaping Crypto Markets for Day Traders?

Key trends shaping crypto markets for day traders include increased volatility, the rise of decentralized finance (DeFi), and the growing influence of institutional investors. Additionally, advancements in trading technology and the emergence of algorithmic trading are crucial. Regulatory developments and the integration of cryptocurrencies into mainstream finance are also significant. Finally, social media sentiment plays a vital role in price movements, making it essential for traders to stay tuned to market discussions.

Which Cryptocurrencies Are Best for Day Trading in 2024?

The best cryptocurrencies for day trading in 2024 include Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB), Cardano (ADA), and Solana (SOL). These coins offer high liquidity, volatility, and established market presence, making them ideal for short-term trades. Look for altcoins with strong price movements and active trading volumes, like Ripple (XRP) and Chainlink (LINK), as they can also provide profitable opportunities. Always monitor market trends and news for the latest insights.

How Can Day Traders Adapt to Market Volatility in Crypto?

Day traders can adapt to market volatility in crypto by implementing several strategies. First, use technical analysis to identify key support and resistance levels, allowing you to make informed entry and exit decisions. Second, set strict stop-loss orders to limit potential losses during sharp price swings. Third, diversify your trades across different cryptocurrencies to spread risk. Additionally, stay updated on market news and sentiment, as these can significantly influence volatility. Finally, practice risk management by only allocating a small percentage of your capital to each trade, ensuring you can weather market fluctuations without substantial losses.

What Tools Do Day Traders Need for Successful Crypto Trading?

Day traders need several essential tools for successful crypto trading:

1. Trading Platform: Use a reliable exchange like Binance or Coinbase Pro for executing trades quickly.

2. Charting Software: Utilize tools like TradingView for technical analysis and real-time charting.

3. Market News Aggregator: Follow platforms like CoinDesk or CryptoPanic for timely news that affects market sentiment.

4. Portfolio Tracker: Employ apps like Blockfolio or Delta to monitor your investments and track performance.

5. Risk Management Tools: Use stop-loss orders to minimize losses and position sizing calculators to manage risk effectively.

6. API Access: For automated trading, access APIs from exchanges to build or use trading bots.

7. Community Forums: Engage with platforms like Reddit or Discord for insights and strategies from other traders.

These tools collectively enhance decision-making and streamline the trading process in the volatile crypto market.

How Does Market Sentiment Affect Day Trading Strategies in Crypto?

Market sentiment significantly impacts day trading strategies in crypto. Traders often analyze social media trends, news, and community discussions to gauge sentiment. Positive sentiment can drive prices up, leading traders to buy, while negative sentiment may trigger sell-offs. Day traders adjust their strategies based on sentiment shifts, employing tactics like momentum trading during bullish phases or short selling in bearish conditions. Understanding sentiment allows traders to anticipate market movements and make informed decisions quickly, crucial for the volatile crypto landscape.

What Are the Risks of Day Trading in the Crypto Market?

Day trading in the crypto market carries several risks. High volatility can lead to significant losses in a short time. The lack of regulation increases the chance of fraud or market manipulation. Additionally, emotional decision-making can result in poor trades. Technical issues, like exchange outages, can disrupt trading. Lastly, leverage can amplify losses, turning a small downturn into a substantial financial hit.

How Can Day Traders Use Technical Analysis in Crypto?

Day traders can use technical analysis in crypto by analyzing price charts, identifying patterns, and utilizing indicators. Tools like moving averages help spot trends, while oscillators like the RSI indicate overbought or oversold conditions. Candlestick patterns reveal market sentiment, aiding in entry and exit points. Volume analysis can confirm trends, ensuring decisions are backed by solid data. By combining these techniques, day traders can make informed, timely trades in the volatile crypto markets.

What Are the Best Platforms for Day Trading Cryptocurrencies?

The best platforms for day trading cryptocurrencies include Binance, Coinbase Pro, Kraken, and Bitfinex. These platforms offer low fees, high liquidity, and a wide range of trading pairs. Binance is known for its advanced trading features, while Coinbase Pro is user-friendly for beginners. Kraken provides strong security measures, and Bitfinex offers margin trading options. Choose a platform based on your trading style and needs.

How Does Liquidity Influence Day Trading in Crypto?

Liquidity significantly impacts day trading in crypto by affecting how easily traders can buy and sell assets without causing price fluctuations. Higher liquidity allows for quicker transactions and tighter spreads, reducing trading costs. In contrast, low liquidity can lead to slippage, where the executed price differs from the expected price, increasing risk. As crypto markets evolve, liquidity is crucial for day traders aiming for consistent profits and minimizing losses.

What Role Does Social Media Play in Crypto Day Trading?

Social media plays a crucial role in crypto day trading by providing real-time information, market sentiment, and trading signals. Platforms like Twitter and Reddit facilitate discussions that can influence price movements and trends. Traders often use social media to gauge public sentiment and discover emerging coins or trading opportunities. Additionally, influencers can sway opinions, making it vital for day traders to monitor these platforms for potential market shifts. Overall, staying active on social media helps traders make informed decisions quickly in the volatile crypto market.

Learn about Impact of Social Media on Crypto Day Trading Decisions

How Can Day Traders Manage Their Emotions in Crypto Trading?

Day traders can manage their emotions in crypto trading by setting strict trading plans with clear entry and exit points. Use stop-loss orders to limit potential losses and take-profit levels to secure gains. Maintain a disciplined approach by sticking to your strategy, regardless of market volatility. Take regular breaks to avoid burnout and emotional fatigue. Engage in mindfulness or meditation to stay centered and reduce stress. Keeping a trading journal can help you reflect on your trades and emotional responses, allowing for better decision-making in the future. Lastly, educating yourself continuously about market trends can bolster confidence and reduce anxiety.

How Can Day Traders Choose the Best Crypto Markets for Future Success?

To choose the best crypto markets for day trading, consider liquidity, volatility, trading fees, and market depth. Look for platforms with high trading volume and low spreads. Analyze historical price movements and use technical analysis tools to identify trends. Always assess security measures and regulatory compliance of the exchanges.

Learn more about: How to Choose the Best Crypto Markets for Day Trading

Learn about How to Choose the Best Crypto Markets for Day Trading

What Are the Tax Implications of Day Trading Cryptocurrencies?

Day trading cryptocurrencies typically results in short-term capital gains, which are taxed as ordinary income. In the U.S., if you hold a cryptocurrency for less than a year before selling, any profit is taxed at your income tax rate. You must report all trades on your tax return, including losses, which can offset gains. Additionally, some jurisdictions may have specific regulations or reporting requirements for crypto transactions. Always consider consulting a tax professional for personalized advice.

Learn about Tax Implications of Forex Day Trading

How Is AI Changing the Landscape for Day Traders in Crypto?

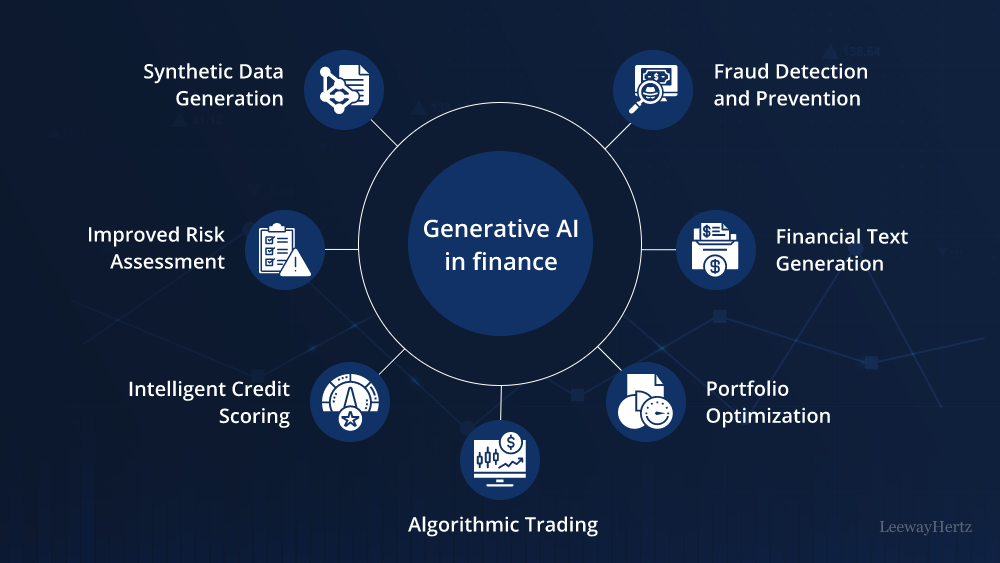

AI is transforming day trading in crypto by enhancing data analysis, improving trading strategies, and automating processes. Advanced algorithms analyze market trends and price movements in real-time, allowing traders to make quicker, informed decisions. AI-driven tools assist in identifying patterns and predicting price fluctuations, which can lead to more profitable trades. Additionally, automation reduces the emotional stress of trading, enabling traders to execute strategies without hesitation. Overall, AI equips day traders with powerful insights and efficiency, reshaping their approach to the volatile crypto market.

What Strategies Can Day Traders Use in Bear Markets for Crypto?

Day traders in bear markets for crypto can use several strategies:

1. Short Selling: Profit from falling prices by borrowing and selling crypto assets, then buying them back at a lower price.

2. Scalping: Make quick trades to capture small price movements, focusing on high volatility.

3. Dollar-Cost Averaging: Gradually invest a set amount in crypto to mitigate the impact of price drops.

4. Hedging: Use derivatives like futures or options to protect against losses in long positions.

5. Trend Following: Identify and trade with the prevailing downward trend, using technical indicators to signal entry and exit points.

6. Market Sentiment Analysis: Monitor news and social media to gauge market sentiment and make informed trading decisions.

7. Liquidity Management: Focus on highly liquid assets to ensure quick entry and exit, minimizing slippage.

8. Risk Management: Set stop-loss orders to limit potential losses and only risk a small percentage of your capital on each trade.

Implementing these strategies can help day traders navigate bear markets effectively.

How Can Day Traders Stay Updated on Crypto Market News?

Day traders can stay updated on crypto market news by following these methods:

1. News Aggregators: Use platforms like CoinDesk, CoinTelegraph, and CryptoSlate for real-time news.

2. Social Media: Follow influential traders and analysts on Twitter and Reddit for insights and trends.

3. Telegram Groups: Join crypto-specific groups for instant updates and discussions.

4. Market Analysis Tools: Utilize tools like TradingView for charts and analytics to track market movements.

5. Podcasts and YouTube Channels: Listen to experts discussing market trends and forecasts.

6. Crypto News Apps: Download apps like BlockFi and CryptoPro for alerts on significant news and price changes.

Staying informed through these channels helps day traders make timely decisions in the volatile crypto market.

Learn about How to Stay Updated on Crypto Market News for Day Trading

Conclusion about The Future of Crypto Markets for Day Traders

The landscape of crypto markets continues to evolve, presenting both challenges and opportunities for day traders. As regulatory changes unfold, understanding key trends, market sentiment, and liquidity will be vital. Utilizing the right tools and strategies, especially in volatile conditions, can enhance trading success. Awareness of risks and emotional management are equally important. For those looking to thrive in this dynamic environment, DayTradingBusiness offers valuable insights and resources to navigate the future of crypto day trading effectively.

Sources:

- Women and Trading: Currencies, Commodities, and Crypto | CFA ...

- The day of the week effect in the cryptocurrency market - ScienceDirect

- Cryptocurrency trading and its associations with gambling and ...

- Preliminary findings on cryptocurrency trading among regular ...

- Speculation and lottery-like demand in cryptocurrency markets ...

- World Bank Document