Did you know that the average day trader spends more time looking at charts than a cat does staring at a laser pointer? In the fast-paced world of day trading ETFs, having the right strategies can make all the difference. This article dives into essential tactics for selecting the right ETFs, understanding key indicators, and managing risk effectively. You'll learn how to develop a solid day trading plan, utilize market volatility to your advantage, and apply technical analysis for better decision-making. We’ll also cover the tax implications, the use of margin, and the best tools needed to enhance your trading experience. Plus, we’ll highlight common mistakes to avoid and how to stay updated on market news, ensuring you’re well-equipped to navigate the ETF landscape. Let DayTradingBusiness guide you toward successful ETF day trading!

What are the best strategies for day trading ETFs?

1. Technical Analysis: Focus on chart patterns, indicators like moving averages, and volume analysis to identify entry and exit points.

2. Set Clear Goals: Define profit targets and stop-loss levels before entering trades to minimize risk and maximize gains.

3. Watch Market News: Stay updated on economic reports and news that can impact the ETFs you're trading, as timely information can influence price movements.

4. Use Limit Orders: Employ limit orders instead of market orders to control entry and exit prices, avoiding slippage.

5. Diversify Your Trades: Trade multiple ETFs across different sectors to spread risk and increase opportunities.

6. Keep Emotions in Check: Stick to your trading plan and avoid impulsive decisions based on fear or greed.

7. Practice Risk Management: Limit the capital you risk on each trade to a small percentage of your total account balance.

8. Review and Adapt: Regularly analyze your trades to learn from mistakes and refine your strategies.

How do I choose the right ETFs for day trading?

To choose the right ETFs for day trading, focus on liquidity, volatility, and trading volume. Look for ETFs with high average daily trading volumes; this ensures you can enter and exit positions easily. Select those with greater price fluctuations, as they offer more opportunities for profit within a day. Additionally, consider sector ETFs that respond quickly to news or economic data, like technology or energy. Check expense ratios; lower fees can enhance your returns. Use technical analysis to identify entry and exit points effectively. Lastly, keep an eye on market trends and news that could impact your chosen ETFs.

What are the key indicators to watch in day trading ETFs?

Key indicators to watch in day trading ETFs include:

1. Volume: High trading volume indicates strong interest and liquidity, crucial for quick trades.

2. Price Action: Monitor price movements and patterns for entry and exit points.

3. Moving Averages: Use short-term moving averages to identify trends and potential reversals.

4. Relative Strength Index (RSI): Look for overbought or oversold conditions to gauge potential price movements.

5. Bollinger Bands: These help identify volatility and potential breakout points.

6. Market News: Stay updated on economic reports and news that can impact ETF performance.

7. Sector Performance: Track how the underlying sectors are performing, as they directly affect ETF prices.

Focus on these indicators for effective day trading strategies with ETFs.

How can I manage risk when day trading ETFs?

To manage risk when day trading ETFs, set a strict stop-loss order for each trade to limit potential losses. Use position sizing to ensure no single trade risks more than 1-2% of your capital. Diversify across different sectors or industries to spread risk. Monitor market trends and news closely, as they can impact ETF prices. Implement a daily loss limit to prevent emotional trading. Finally, practice with a demo account to refine your strategies without financial risk.

What timeframes are most effective for day trading ETFs?

The most effective timeframes for day trading ETFs are typically 1-minute, 5-minute, and 15-minute charts. These allow for quick decision-making and capturing short-term price movements. Many traders also use the 30-minute and hourly charts for trend analysis and entry/exit points. Focus on high-volume trading hours, particularly at market open and close, for better volatility and opportunities.

How do I develop a day trading plan for ETFs?

To develop a day trading plan for ETFs, follow these steps:

1. Define Goals: Set clear, realistic profit targets and risk tolerance levels.

2. Choose ETFs: Select liquid ETFs with high trading volume and volatility to ensure quick entry and exit.

3. Analyze Charts: Use technical analysis to identify entry and exit points. Focus on patterns, support, and resistance levels.

4. Set Rules: Establish specific criteria for entering and exiting trades. This could include price movements, indicators, or news events.

5. Risk Management: Decide on a stop-loss strategy to limit losses and protect your capital.

6. Practice: Use a paper trading account to test your strategy without risking real money.

7. Review Performance: Regularly analyze your trades to identify strengths and weaknesses, and adjust your plan accordingly.

Stick to your plan and stay disciplined.

What role does market volatility play in ETF day trading?

Market volatility is crucial for ETF day trading as it creates price fluctuations, allowing traders to capitalize on short-term movements. High volatility can lead to larger price swings, providing more opportunities for profit. Traders often use technical analysis and indicators to identify entry and exit points during volatile periods. Effective strategies include setting tight stop-loss orders to manage risk and leveraging volume spikes to confirm trends. Understanding volatility helps traders make informed decisions and adjust their strategies quickly to maximize gains while minimizing losses.

How can I use technical analysis in ETF day trading?

To use technical analysis in ETF day trading, follow these strategies:

1. Identify Trends: Use moving averages to determine the overall trend. A simple moving average (SMA) can show support and resistance levels.

2. Volume Analysis: Monitor trading volume alongside price movements. High volume can confirm trends or signal reversals.

3. Chart Patterns: Look for patterns like triangles, flags, or head and shoulders. These can indicate potential breakout points.

4. Indicators: Utilize indicators such as RSI (Relative Strength Index) to identify overbought or oversold conditions, helping you decide entry and exit points.

5. Candlestick Analysis: Study candlestick patterns for insights into market sentiment. Patterns like doji or engulfing can signal reversals.

6. Timeframes: Focus on shorter timeframes (5-minute or 15-minute charts) for day trading. This provides a clearer picture of intraday price movements.

7. Set Stop Losses: Use technical levels to place stop-loss orders, protecting your capital from sudden market swings.

8. Backtest Strategies: Before trading live, backtest your strategies using historical data to gauge effectiveness.

Implement these techniques to enhance your ETF day trading performance.

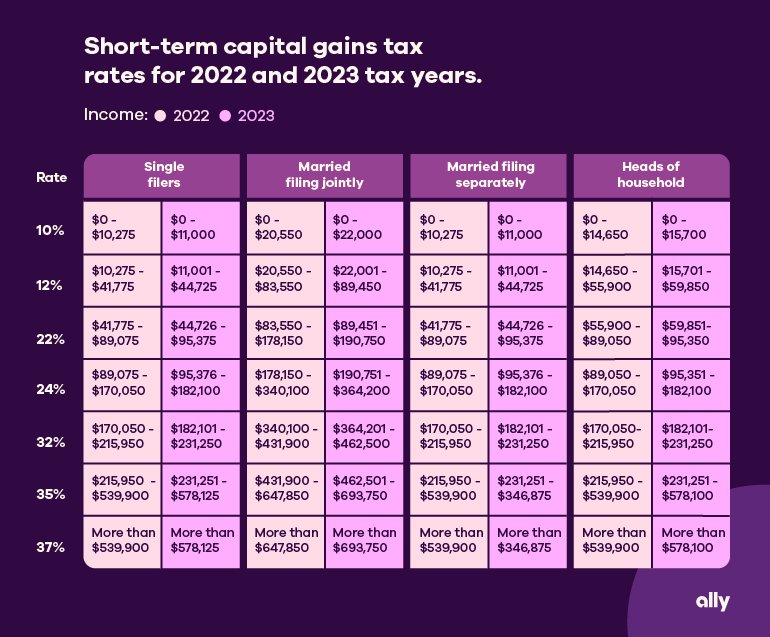

What are the tax implications of day trading ETFs?

Day trading ETFs can have significant tax implications. Profits from day trading are typically considered short-term capital gains, taxed at your ordinary income tax rate. This can be higher than the long-term capital gains rate. Additionally, frequent trading may lead to a higher tax liability due to the number of transactions reported on your tax return. It's crucial to keep detailed records of your trades to accurately report gains and losses. Consider consulting a tax professional for personalized advice tailored to your trading strategy.

How can I leverage margin in ETF day trading?

To leverage margin in ETF day trading, first, open a margin account with your broker. This allows you to borrow funds to increase your buying power. Next, choose liquid ETFs with high volatility to maximize potential gains. Use technical analysis to identify entry and exit points. Keep a close eye on margin requirements and avoid over-leveraging, as this increases risk. Implement stop-loss orders to protect your capital. Finally, monitor market news and trends to make informed decisions.

What tools and platforms are recommended for day trading ETFs?

For day trading ETFs, recommended tools and platforms include:

1. Brokerage Platforms: Use TD Ameritrade, E*TRADE, or Interactive Brokers for robust trading features and low commissions.

2. Charting Software: TradingView and Thinkorswim provide advanced charting tools to analyze price movements.

3. News Aggregators: Tools like Benzinga and Yahoo Finance keep you updated on market news and events impacting ETFs.

4. Trading Simulators: Consider using paper trading accounts on your brokerage to practice strategies without risk.

5. Stock Screeners: Finviz and Trade Ideas help identify potential ETF trades based on technical and fundamental criteria.

6. Risk Management Tools: Use stop-loss and take-profit orders to manage risk effectively.

7. Mobile Apps: Platforms like Robinhood and Webull offer convenient trading on the go.

These tools enhance your ability to execute trades efficiently and make informed decisions.

How do I set stop-loss orders for ETF day trades?

To set stop-loss orders for ETF day trades, first determine your risk tolerance and the maximum loss you're willing to accept. Identify a price level below your entry point where you will exit the trade to limit losses. Use a market or limit order to place the stop-loss, ensuring it’s positioned at that predetermined price. Regularly monitor your trade and adjust the stop-loss if the ETF moves favorably, locking in profits as needed.

What Are the Best Strategies and ETFs for Effective Day Trading?

The best ETFs for day trading include SPDR S&P 500 ETF Trust (SPY), Invesco QQQ Trust (QQQ), and iShares Russell 2000 ETF (IWM). For effective strategies, focus on high liquidity ETFs, use technical analysis for entry and exit points, and set strict stop-loss orders to manage risk.

Learn more about: What Are the Best ETFs for Day Trading?

Learn about What Are the Best ETFs for Day Trading?

What are common mistakes to avoid in ETF day trading?

Common mistakes to avoid in ETF day trading include:

1. Ignoring Volume: Trading ETFs with low volume can lead to high spreads and slippage.

2. Neglecting Research: Failing to understand the underlying assets can result in poor decisions.

3. Overtrading: Making too many trades can increase costs and reduce profits.

4. Lack of a Trading Plan: Not having clear entry and exit strategies can lead to emotional trading.

5. Ignoring Market Conditions: Not considering overall market trends can impact ETF performance.

6. Failure to Use Stop Losses: Not setting stop losses can result in significant losses.

7. Chasing Losses: Trying to recover losses by risking more can lead to even bigger losses.

8. Misunderstanding Fees: Not accounting for fees can erode profits, especially in frequent trading.

Avoiding these pitfalls can enhance your day trading success with ETFs.

Learn about Common Mistakes in Day Trading Scalping and How to Avoid Them

How can I stay updated on ETF market news?

To stay updated on ETF market news, follow these strategies:

1. Use Financial News Websites: Regularly check sites like Bloomberg, CNBC, and Reuters for real-time ETF news.

2. Set Up Alerts: Use Google Alerts or financial apps to get notifications on specific ETFs or market trends.

3. Follow Social Media: Engage with finance experts and ETF analysts on Twitter and LinkedIn for insights and updates.

4. Join Online Communities: Participate in forums like Reddit’s r/investing or specialized ETF groups on Facebook.

5. Subscribe to Newsletters: Sign up for daily or weekly newsletters from trusted financial analysts focusing on ETFs.

6. Utilize Trading Platforms: Many brokerage platforms offer news feeds and market analysis specifically for ETFs.

Incorporate these methods to stay informed and enhance your day trading strategies effectively.

Learn about How to Stay Updated on Crypto Market News for Day Trading

What is the impact of liquidity on day trading ETFs?

Liquidity impacts day trading ETFs significantly. High liquidity allows for quick entry and exit, minimizing slippage and ensuring you get the price you expect. It also means tighter bid-ask spreads, which reduces trading costs. Low liquidity can lead to larger price swings and difficulty executing trades without affecting the market. For effective day trading, focus on ETFs with high average daily volume to enhance your chances of executing trades efficiently.

How do I evaluate ETF performance for day trading?

To evaluate ETF performance for day trading, focus on these key factors:

1. Liquidity: Check the average daily trading volume. Higher liquidity means easier entry and exit points.

2. Volatility: Look for ETFs with significant price fluctuations throughout the day. This creates opportunities for profit.

3. Bid-Ask Spread: A narrower spread indicates lower trading costs. Aim for ETFs with tight spreads to maximize gains.

4. Technical Indicators: Use charts and indicators like moving averages, RSI, and MACD to identify entry and exit signals.

5. Market News and Trends: Stay updated on market news that can impact ETF prices. Economic reports and sector developments are crucial.

6. Correlation: Understand how the ETF correlates with its underlying index or sector. This helps in anticipating price movements.

7. Historical Performance: Analyze past performance during similar market conditions to gauge potential future behavior.

Implement these strategies to effectively evaluate and trade ETFs in a day trading context.

Conclusion about Strategies for Day Trading ETFs Effectively

In conclusion, effectively day trading ETFs requires a solid understanding of strategies, risk management, and market indicators. Choosing the right ETFs, employing technical analysis, and staying informed about market volatility are crucial for success. Additionally, leveraging the right tools and platforms can enhance your trading experience. For comprehensive insights and guidance on navigating the complexities of ETF day trading, rely on DayTradingBusiness to elevate your trading skills and knowledge.

Sources:

- Beat the Market An Effective Intraday Momentum Strategy for ...

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- Beat the Market An Effective Intraday Momentum Strategy for ...

- Can Day Trading Really Be Profitable? by Carlo Zarattini, Andrew ...

- Artificial Intelligence Can Make Markets More Efficient—and More ...