Did you know that mood swings can influence stock prices just like they do in your favorite soap opera? Understanding market sentiment is crucial for day traders looking to navigate the ups and downs of stock trading. This article dives into the essence of market sentiment, exploring how it affects stock prices, key indicators to watch, and tools for measurement. We’ll discuss the impact of news, social media, and economic indicators on sentiment, as well as provide insights on how to leverage sentiment analysis to enhance your trading strategies. Discover the differences between bullish and bearish sentiment and learn how institutional investors and major events can sway the market's mood. With expert insights from DayTradingBusiness, you’ll be better equipped to avoid common pitfalls and make informed trading decisions.

What is market sentiment in day trading?

Market sentiment in day trading refers to the overall attitude and emotions of traders toward a particular stock or the market as a whole. It influences buying and selling decisions, impacting short-term price movements. Positive sentiment can lead to increased buying, while negative sentiment can trigger selling. Day traders often analyze news, social media, and technical indicators to gauge sentiment, aiming to capitalize on rapid price changes. Understanding market sentiment helps traders make informed decisions and manage risk effectively.

How does market sentiment affect stock prices?

Market sentiment significantly impacts stock prices by influencing traders' perceptions and decisions. Positive sentiment can drive prices up as more investors buy stocks, anticipating gains. Conversely, negative sentiment often leads to selling, causing prices to drop. In day trading, this sentiment can create volatility; rapid shifts in mood—like news or earnings reports—can lead to quick price movements. Traders often monitor sentiment indicators, such as social media trends or news headlines, to make informed decisions. Ultimately, understanding market sentiment is crucial for predicting short-term price fluctuations in stocks.

What are the key indicators of market sentiment?

Key indicators of market sentiment include:

1. Price Action: Trends and patterns in stock prices can reveal bullish or bearish sentiment.

2. Volume: High trading volume often indicates strong sentiment; increasing volume with price movement signals conviction.

3. Market Indices: Movement in major indices (like the S&P 500) reflects overall market sentiment.

4. News Sentiment: Analyzing headlines and news can gauge how news affects trader psychology.

5. Social Media Trends: Platforms like Twitter and Reddit can show real-time shifts in sentiment among retail traders.

6. Technical Indicators: Tools like the Relative Strength Index (RSI) or Moving Averages can indicate overbought or oversold conditions.

7. Surveys: Investor sentiment surveys can provide insight into market outlook and confidence levels.

These indicators help day traders understand the prevailing mood in the market, guiding their trading decisions.

How can traders measure market sentiment?

Traders can measure market sentiment through various methods. One effective way is by analyzing social media trends and sentiment analysis tools that gauge public opinion on stocks. Additionally, traders often look at indicators like the Fear & Greed Index, which reflects market emotions. Another method is to observe trading volume and price movements—high volume with rising prices usually indicates bullish sentiment, while high volume with falling prices suggests bearish sentiment. Surveys and polls, such as the AAII Sentiment Survey, also provide insights into investor sentiment. Lastly, studying options market data, like put/call ratios, can indicate overall market sentiment.

What tools help analyze market sentiment in day trading?

Tools that help analyze market sentiment in day trading include:

1. Social Media Analytics: Platforms like StockTwits and Twitter provide real-time sentiment analysis based on trader discussions and hashtags.

2. News Aggregators: Tools like Benzinga or Seeking Alpha compile news and headlines that can influence market sentiment quickly.

3. Sentiment Indicators: Metrics such as the Fear & Greed Index or the Put/Call Ratio gauge overall market sentiment.

4. Technical Analysis Software: Platforms like TradingView offer sentiment indicators and charting tools that reflect investor behavior.

5. Volume Analysis Tools: High trading volumes can indicate strong sentiment in a specific direction, which tools like Thinkorswim can help analyze.

Using these tools can enhance your understanding of market sentiment and inform your day trading decisions.

How does news influence market sentiment in stocks?

News significantly influences market sentiment in stocks by shaping investors' perceptions and expectations. Positive news, such as strong earnings reports or favorable regulations, can boost confidence, leading to increased buying activity and rising stock prices. Conversely, negative news, like economic downturns or scandals, can trigger fear and sell-offs, resulting in declining prices. Traders often react quickly to news, amplifying its impact on market sentiment and creating volatility. Understanding this dynamic is essential for day trading, as traders can capitalize on sentiment shifts driven by news events.

What role do social media and forums play in market sentiment?

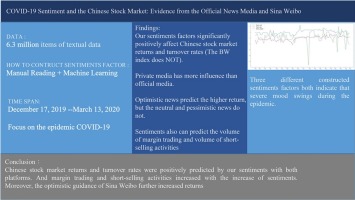

Social media and forums significantly influence market sentiment by shaping public perception and driving discussions around stocks. Traders often gauge sentiment through platforms like Twitter and Reddit, where bullish or bearish opinions can lead to rapid price movements. Positive sentiment can spark buying frenzies, while negative sentiment may trigger sell-offs. Real-time updates and viral trends amplify these effects, making social media a powerful tool for day traders to assess market mood and make quick decisions.

How can sentiment analysis improve day trading strategies?

Sentiment analysis can enhance day trading strategies by providing insights into market emotions and trends. By analyzing social media, news articles, and forums, traders can gauge public sentiment toward specific stocks. Positive sentiment may indicate potential price increases, while negative sentiment can signal declines. This real-time data helps traders make informed decisions, identify entry and exit points, and manage risk more effectively. Incorporating sentiment analysis allows for a more nuanced understanding of market dynamics, leading to better trading outcomes.

What is the difference between bullish and bearish sentiment?

Bullish sentiment indicates optimism about rising stock prices, leading traders to buy in anticipation of gains. Bearish sentiment reflects pessimism, causing traders to sell or short stocks, expecting price declines. In day trading, recognizing these sentiments helps in making informed decisions and timing trades effectively.

How do economic indicators impact market sentiment?

Economic indicators significantly influence market sentiment by shaping traders' perceptions of the economy's health. Positive indicators, like rising employment rates or GDP growth, tend to boost confidence, leading to increased buying activity in stocks. Conversely, negative indicators, such as high inflation or falling consumer spending, can create fear and prompt selling. Traders often react quickly to these signals, adjusting their strategies based on anticipated market movements. This responsiveness to economic data can drive volatility, impacting both short-term gains and overall market trends in day trading.

Can market sentiment lead to stock volatility?

Yes, market sentiment can lead to stock volatility. When traders react emotionally to news or trends, their buying or selling actions can cause rapid price fluctuations. Positive sentiment can drive prices up as more investors buy, while negative sentiment can lead to sell-offs, increasing volatility. For day traders, understanding market sentiment is crucial for making quick, informed decisions.

How Does Market Sentiment Affect the Best Stocks for Day Trading Today?

The best stocks for day trading today are those with high volatility, significant trading volume, and strong news catalysts. Look for stocks in sectors like technology, biotech, and energy. Check pre-market movers and earnings reports for potential opportunities.

Learn more about: Best Stocks for Day Trading Today

Learn about How Market News Affects Day Trading Stocks

How do institutional investors affect market sentiment?

Institutional investors significantly influence market sentiment by trading large volumes of stocks, which can sway prices and investor perception. Their buying or selling activities often signal confidence or concern about specific sectors or the market as a whole. For example, when institutions buy heavily into a stock, it can create a bullish sentiment, encouraging retail investors to follow suit. Conversely, if they start selling, it may trigger panic and lead to bearish sentiment. Overall, their actions can amplify trends and impact day trading strategies.

What are common mistakes related to market sentiment in trading?

Common mistakes related to market sentiment in trading include:

1. Overreacting to News: Traders often make hasty decisions based on headlines without analyzing the underlying fundamentals.

2. Ignoring Contrarian Signals: Following the crowd can lead to losses; ignoring when sentiment is overly bullish or bearish can be detrimental.

3. Chasing Momentum: Jumping into trades based on rising prices without considering market sentiment can result in buying at the peak.

4. Neglecting Technical Indicators: Relying solely on sentiment instead of combining it with technical analysis can lead to poor entry and exit points.

5. Emotional Trading: Allowing fear or greed to drive decisions often leads to impulsive actions rather than sticking to a strategy.

6. Confirmation Bias: Focusing only on information that supports existing beliefs while ignoring opposing data can distort judgment.

7. Failure to Adapt: Sticking to a trading plan despite changing market sentiment can lead to missed opportunities or losses.

Avoiding these mistakes can enhance decision-making and improve trading outcomes.

How can I use sentiment analysis to make better trading decisions?

Use sentiment analysis by monitoring social media, news articles, and financial forums to gauge market mood. Analyze positive or negative sentiments around specific stocks to identify potential price movements. Combine sentiment data with technical indicators to confirm trading signals. For example, if sentiment is bullish and technical indicators show a breakout, it may signal a good buying opportunity. Regularly review sentiment trends to adapt your trading strategy accordingly.

Learn about How to Use Technical Analysis for Options Day Trading

What are the psychological factors behind market sentiment?

Market sentiment in day trading is influenced by several psychological factors:

1. Fear and Greed: Traders often act out of fear of missing out (FOMO) or the fear of losses, driving prices up or down rapidly.

2. Herd Behavior: Many traders follow the crowd, leading to trends where decisions are based on what others are doing rather than fundamentals.

3. Overconfidence: Traders may overestimate their knowledge or skill, leading to risky decisions and market swings.

4. Loss Aversion: The tendency to prefer avoiding losses over acquiring equivalent gains can lead to conservative trading strategies.

5. Anchoring: Traders might fixate on past prices or news, impacting their judgment and decision-making.

These psychological factors create volatility and influence trading patterns, making market sentiment a crucial aspect of day trading stocks.

How do major events impact market sentiment and day trading?

Major events like earnings reports, economic data releases, or geopolitical developments significantly impact market sentiment and day trading. Positive news can boost investor confidence, leading to increased buying pressure and rising stock prices. Conversely, negative news can trigger panic selling, causing sharp declines. Day traders often react quickly to these shifts, using news to inform their strategies. For example, a strong earnings report may lead to a spike in volume as traders jump in, while a political crisis might result in rapid sell-offs. Understanding these dynamics helps traders anticipate market movements and adjust their positions accordingly.

Conclusion about The Role of Market Sentiment in Day Trading Stocks

In summary, understanding market sentiment is crucial for successful day trading. It influences stock prices, volatility, and the overall trading environment. By leveraging key indicators and tools, traders can effectively measure sentiment and incorporate it into their strategies. Awareness of psychological factors and the impact of news and social media further enhances decision-making. Integrating these insights can lead to improved trading outcomes. For those seeking to refine their approach, the expertise offered by DayTradingBusiness can provide invaluable guidance in navigating the complexities of market sentiment.

Learn about Day Trading Stocks During Market Volatility