Did you know that some traders can spend as much time analyzing charts as a chef spends perfecting a soufflé? In the world of trading, understanding the nuances between swing trading and day trading breakouts can make all the difference in your strategy and success. This article dives into the definitions and differences between swing trading and day trading, explores the concept of breakouts in both styles, and highlights their respective advantages. You'll also find effective strategies, key indicators, and tips on managing your time and emotions while trading. Whether you're leaning towards swing trading or day trading, DayTradingBusiness equips you with essential insights to navigate your trading journey confidently.

What is swing trading and how does it differ from day trading?

Swing trading involves holding positions for several days to capture short- to medium-term price movements, often using technical analysis to identify breakouts. In contrast, day trading requires buying and selling within the same trading day, focusing on immediate price fluctuations. The key difference lies in the holding period: swing traders aim for larger price moves over days, while day traders capitalize on quick, intraday trades.

What are breakouts in swing trading?

Breakouts in swing trading refer to a stock or asset moving above a resistance level or below a support level, indicating a potential significant price movement. Swing traders look for these breakouts to enter trades, aiming to capitalize on momentum over several days or weeks. Unlike day trading, which focuses on quick trades within a single day, swing trading allows traders to hold positions longer, benefiting from larger price swings.

How do breakouts work in day trading?

Breakouts in day trading occur when a stock price moves above a resistance level or below a support level with increased volume. Traders look for these price movements to enter positions, anticipating a continued trend in that direction. In day trading, breakouts are typically short-lived, requiring quick decision-making. Unlike swing trading, where positions are held longer, day traders aim to capitalize on rapid price movements and close positions within the same day. Effective breakout strategies include identifying key levels, using volume as confirmation, and setting stop-loss orders to manage risk.

What are the key differences between swing trading and day trading breakouts?

Swing trading breakouts focus on holding positions for several days to capture larger price movements, while day trading breakouts involve entering and exiting positions within the same trading day to profit from quick price fluctuations. Swing traders typically use daily or weekly charts, seeking to identify trends and patterns over a longer time frame. In contrast, day traders rely on minute or hourly charts, acting quickly on market news or technical signals. Additionally, swing trading often requires less time monitoring the market, whereas day trading demands constant attention and rapid decision-making.

What are the advantages of swing trading breakouts?

Swing trading breakouts offer several advantages. First, they require less time commitment than day trading, allowing traders to focus on a few key setups over several days. Second, they capture larger price movements, maximizing profit potential. Third, swing trading reduces the stress of constant monitoring, making it easier to analyze trends and make informed decisions. Finally, it often involves less transaction cost due to fewer trades, allowing for better overall profitability.

What are the benefits of day trading breakouts?

Day trading breakouts can lead to quick profits by capitalizing on significant price movements. They allow traders to enter positions as stocks break through resistance levels, often resulting in momentum. This strategy offers high potential returns in a short time frame, reduces overnight risk, and requires less capital compared to swing trading. Additionally, it provides immediate feedback on trades, enabling quick adjustments. Overall, day trading breakouts can enhance trading efficiency and profit opportunities.

How should I choose between swing trading and day trading?

Choose swing trading if you prefer holding positions for several days to capture larger price movements. It suits those with limited time for constant monitoring. Opt for day trading if you want to capitalize on short-term price fluctuations and can dedicate hours each day to trading. Consider your risk tolerance, available time, and trading style to make the best decision.

What strategies are effective for swing trading breakouts?

Effective strategies for swing trading breakouts include:

1. Identify Key Levels: Look for resistance and support levels on the chart. Breakouts often happen when the price surpasses these levels.

2. Volume Confirmation: Ensure there’s increased trading volume during the breakout. Higher volume indicates strong interest and validity of the move.

3. Use Technical Indicators: Utilize indicators like the Moving Average Convergence Divergence (MACD) or Relative Strength Index (RSI) to assess momentum and potential reversals.

4. Set Stop-Loss Orders: Protect your capital by placing stop-loss orders just below the breakout level to minimize losses if the trade goes against you.

5. Define Target Levels: Establish profit targets based on previous price action or Fibonacci retracement levels to guide your exit strategy.

6. Time Your Entry: Enter after a confirmed breakout rather than preemptively to avoid false breakouts. Wait for the candle close above the breakout level.

7. Monitor Market News: Stay updated on relevant news that can influence price movements and cause volatility around your breakout levels.

Implement these strategies to enhance your swing trading success with breakouts.

What strategies are best for day trading breakouts?

For day trading breakouts, focus on these strategies:

1. Identify Key Levels: Use chart patterns to spot support and resistance levels. Breakouts often occur when price surpasses these levels.

2. Volume Analysis: Look for increased volume during a breakout. High volume confirms strength behind the move.

3. Use Stop Losses: Set tight stop losses just below the breakout point to minimize losses if the trade reverses.

4. Time Your Entry: Enter trades as soon as the price breaks above resistance or below support, ideally within the first few minutes of the move.

5. Focus on Liquid Stocks: Trade stocks with high liquidity to ensure quick entry and exit without slippage.

6. Monitor News and Events: Stay updated on news that might impact stock price, as breakouts often follow significant announcements.

7. Set Profit Targets: Determine profit targets based on previous highs or calculated risk-reward ratios to ensure disciplined exit points.

These strategies can enhance your effectiveness in day trading breakouts.

How do I identify breakout patterns in swing trading?

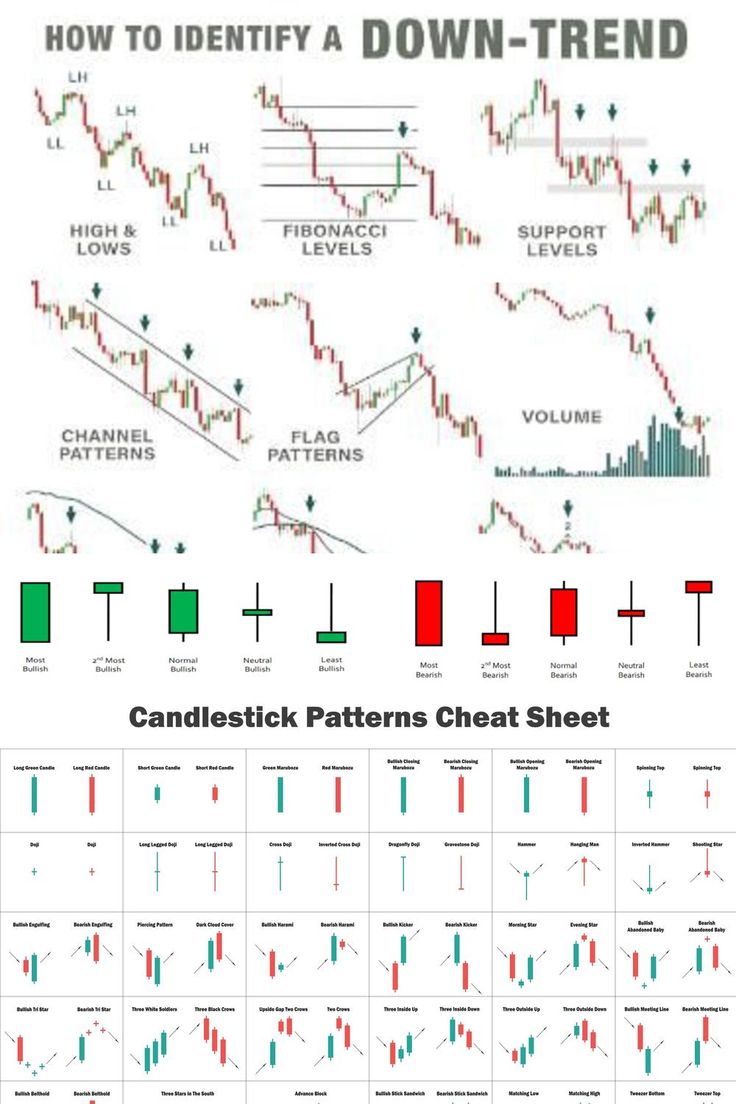

To identify breakout patterns in swing trading, focus on these key steps:

1. Chart Patterns: Look for classic patterns like triangles, flags, and head-and-shoulders that indicate potential breakouts.

2. Support and Resistance Levels: Identify key support and resistance levels. A breakout occurs when the price moves above resistance or below support.

3. Volume Confirmation: Ensure that the breakout is accompanied by increased trading volume. Higher volume often confirms the strength of the breakout.

4. Time Frames: Use daily or weekly charts for swing trading. Look for price action over a few days to weeks.

5. Indicators: Utilize indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) to gauge momentum during a breakout.

6. News Events: Be aware of news or earnings reports that may trigger breakouts.

Apply these techniques to spot breakout patterns effectively in your swing trading strategy.

What indicators can help with day trading breakouts?

Key indicators for day trading breakouts include:

1. Volume: Increased volume often confirms the strength of a breakout.

2. Relative Strength Index (RSI): An RSI above 70 may indicate overbought conditions, while below 30 suggests oversold, helping identify potential reversals.

3. Moving Averages: Crossovers, like the 50-day moving average crossing above the 200-day, can signal bullish breakouts.

4. Bollinger Bands: Price touching the upper band may indicate a breakout, while squeezing bands suggest potential volatility.

5. Candlestick Patterns: Look for patterns like bullish engulfing or doji candles near key resistance levels for breakout signals.

These indicators collectively enhance the likelihood of successful day trading breakouts.

How much time should I dedicate to swing trading versus day trading?

For swing trading, dedicate about 5-10 hours a week to analyze charts, set up trades, and manage positions. For day trading, allocate 3-6 hours daily, focusing on intraday movements and quick decisions. Your choice depends on your availability and risk tolerance.

Learn about How to Time Your Day Trading Entries and Exits

What risks should I consider with swing trading breakouts?

When swing trading breakouts, consider these risks:

1. False Breakouts: Prices may spike beyond resistance but quickly reverse, leading to losses.

2. Market Volatility: Sudden market moves can trigger stop-loss orders and result in unexpected losses.

3. Timing Issues: Entering too early or too late can diminish profit potential.

4. Lack of Volume: Low trading volume on breakouts can indicate weak momentum, increasing risk.

5. News Events: Earnings reports or economic data can cause sudden price swings that disrupt your strategy.

Stay aware of these factors to mitigate risks effectively.

What are common pitfalls in day trading breakouts?

Common pitfalls in day trading breakouts include chasing after price movements, which can lead to false breakouts; failing to set stop-loss orders, increasing risk; ignoring volume confirmation, which can signal the strength of a breakout; and not having a clear exit strategy, resulting in missed profit opportunities. Additionally, overtrading and allowing emotions to dictate decisions can lead to significant losses.

How Do Day Trading Breakout Strategies Compare to Swing Trading Breakouts?

Day trading breakout strategies involve entering a trade when the price breaks above resistance or below support, aiming for quick profits. In contrast, swing trading breakouts focus on capturing larger price movements over several days or weeks, relying on longer-term trends rather than immediate price action.

Learn more about: What Are Day Trading Breakout Strategies?

Learn about How to Backtest Futures Day Trading Strategies

How can I manage my emotions in swing trading and day trading?

To manage your emotions in swing trading and day trading, establish a clear trading plan with defined entry and exit points. Stick to this plan, regardless of market fluctuations. Use stop-loss orders to limit potential losses, which can reduce anxiety. Practice mindfulness techniques to stay calm during trades. Keep a trading journal to reflect on your decisions and emotions. Avoid overtrading; take breaks if you're feeling overwhelmed. Lastly, focus on the process rather than immediate profits to maintain a balanced mindset.

What tools and platforms are best for swing trading and day trading?

For swing trading and day trading breakouts, the best tools and platforms include:

1. TradingView: Excellent for charting and technical analysis with customizable indicators.

2. MetaTrader 4/5: Popular for automated trading and expert advisors.

3. Thinkorswim: Comprehensive platform with advanced trading tools and research resources.

4. Webull: Offers commission-free trading and robust mobile access.

5. TD Ameritrade: Great for research and educational resources.

6. E*TRADE: User-friendly interface and powerful trading tools.

These platforms help identify breakouts effectively and facilitate quick trades.

Learn about Best Platforms for Day Trading ETFs

Conclusion about Swing Trading vs. Day Trading Breakouts

In summary, understanding the distinctions between swing trading and day trading breakouts is crucial for optimizing your trading strategy. Both approaches offer unique advantages and challenges, with swing trading catering to those preferring longer positions and day trading appealing to those who thrive on quick, high-frequency trades. By considering your personal goals, risk tolerance, and the right tools, you can make informed decisions for success in the trading landscape. For more tailored insights and strategies, DayTradingBusiness is here to support your journey in mastering these trading techniques.

Learn about Day Trading vs. Swing Trading: What's the Difference?