Did you know that the shortest trading timeframe can sometimes feel like trying to catch a squirrel on espresso? When it comes to momentum day trading, selecting the right timeframe is crucial for maximizing profits and minimizing risks. This article dives into the best timeframes for momentum trading, exploring the benefits of 1-minute, 5-minute, and 15-minute charts, as well as the 30-minute and hourly options. Discover how different timeframes can impact your trading decisions, the advantages of using multiple timeframes, and the relationship between volatility and timeframes. With insights tailored for both beginners and seasoned traders, this guide by DayTradingBusiness will help you navigate the fast-paced world of day trading with confidence.

What are the best timeframes for momentum day trading?

The best timeframes for momentum day trading are typically 1-minute, 5-minute, and 15-minute charts. The 1-minute chart is useful for quick trades and capturing rapid price movements. The 5-minute chart offers a balance between speed and detail, making it ideal for identifying short-term trends. The 15-minute chart helps traders spot potential reversals or continuations with more context. Additionally, using a combination of these timeframes can provide a clearer picture of market momentum.

How do I choose the right timeframe for day trading?

To choose the right timeframe for momentum day trading, focus on shorter timeframes like 1-minute to 15-minute charts. These allow you to capture quick price movements. Use the 5-minute chart for a balance between detail and overview, while the 15-minute chart can help identify broader trends. Test different timeframes to see which aligns best with your trading style and strategy. Always consider market volatility and your ability to react quickly.

Why is the 1-minute chart popular among day traders?

The 1-minute chart is popular among day traders because it provides quick insights into price movements, allowing for rapid decision-making. Traders can spot trends and reversals almost instantly, enabling them to capitalize on short-term volatility. The fast pace suits those who thrive on quick trades and immediate feedback, maximizing potential profits in a single session. Additionally, it helps in refining entry and exit points, essential for momentum trading.

What advantages does the 5-minute timeframe offer for momentum trading?

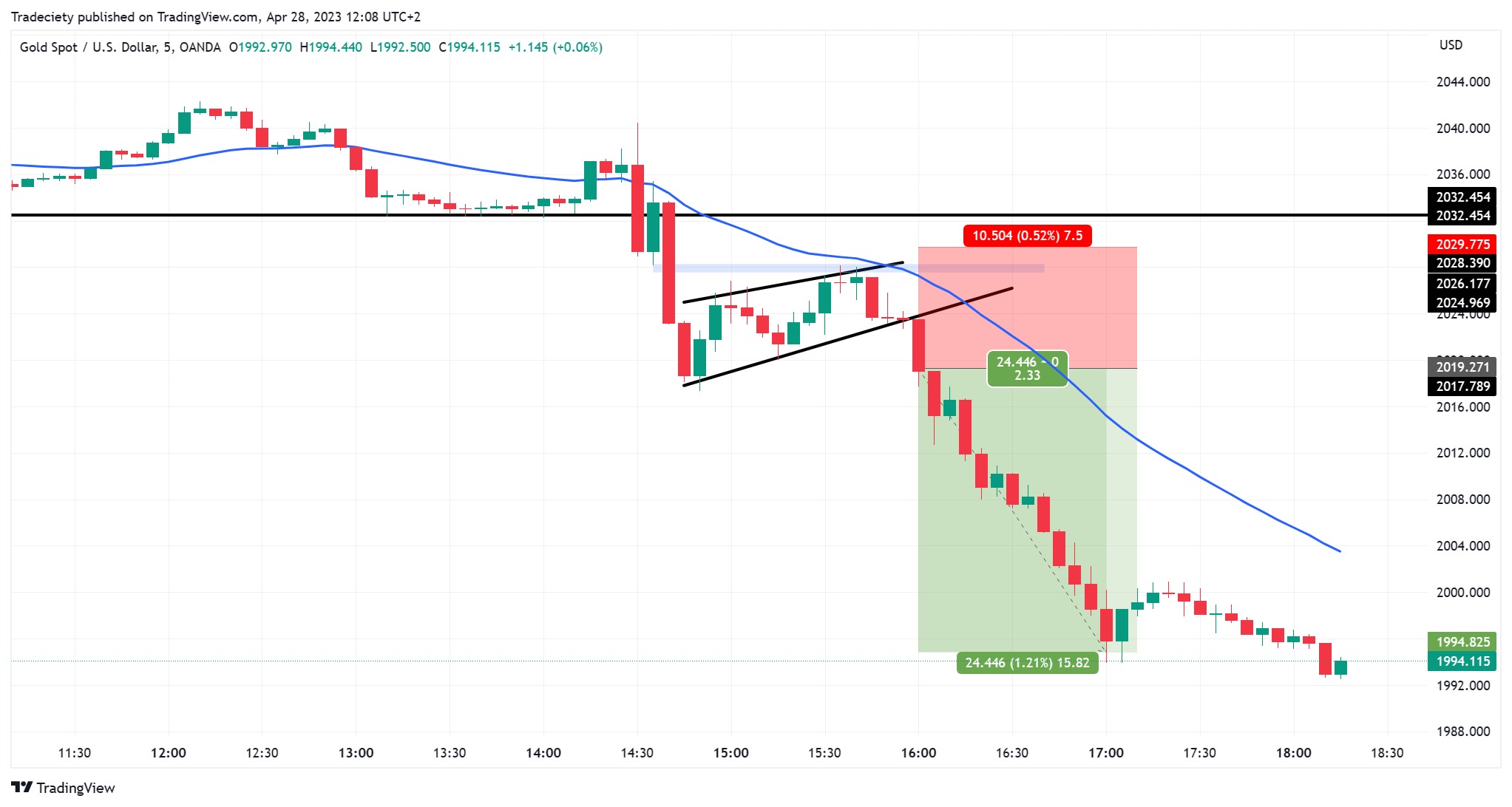

The 5-minute timeframe for momentum trading provides quick entry and exit opportunities, allowing traders to capitalize on short-term price movements. It offers a balance between noise and trend clarity, enabling traders to spot momentum shifts without excessive market fluctuations. This timeframe also enhances reaction speed to news and events, facilitating timely trades. Additionally, the 5-minute chart captures more data points than longer timeframes, improving decision-making through better trend analysis. Overall, it’s ideal for traders seeking fast-paced action and immediate results.

How does the 15-minute chart impact trading decisions?

The 15-minute chart helps traders identify short-term trends and price movements, making it easier to spot entry and exit points. It balances detail and overview, providing enough data to make quick decisions without overwhelming noise. Traders use it to set stop-loss orders and take profits, ensuring they stay aligned with momentum. This timeframe allows for timely reactions to market news and developments, enhancing overall trading strategy effectiveness.

Is the 30-minute timeframe effective for day trading momentum?

Yes, the 30-minute timeframe is effective for momentum day trading. It strikes a balance between capturing price movements and minimizing noise. Traders can identify trends and entry points while still having enough data to make informed decisions. Many traders find that this timeframe allows for timely reactions to market changes, enhancing potential profit opportunities.

What role does the hourly chart play in momentum day trading?

The hourly chart is crucial in momentum day trading as it helps traders identify short-term trends and potential entry or exit points. It provides a clearer view of price action over a longer period than minute charts, reducing noise and false signals. By analyzing the hourly chart, traders can spot momentum shifts, support and resistance levels, and trade setups that align with the overall market direction. This timeframe balances detail with broader context, making it ideal for capturing quick, profitable trades.

How do different timeframes affect trade execution?

Different timeframes significantly impact trade execution in momentum day trading. Shorter timeframes, like 1-minute or 5-minute charts, allow for quick entries and exits, capturing small price movements but can lead to more noise and false signals. Medium timeframes, such as 15-minute or 30-minute charts, provide a balance, offering clearer trends while still enabling timely trades. Longer timeframes, like hourly charts, may yield more reliable signals but could miss rapid momentum shifts. Choosing the right timeframe depends on your trading strategy, risk tolerance, and ability to monitor trades.

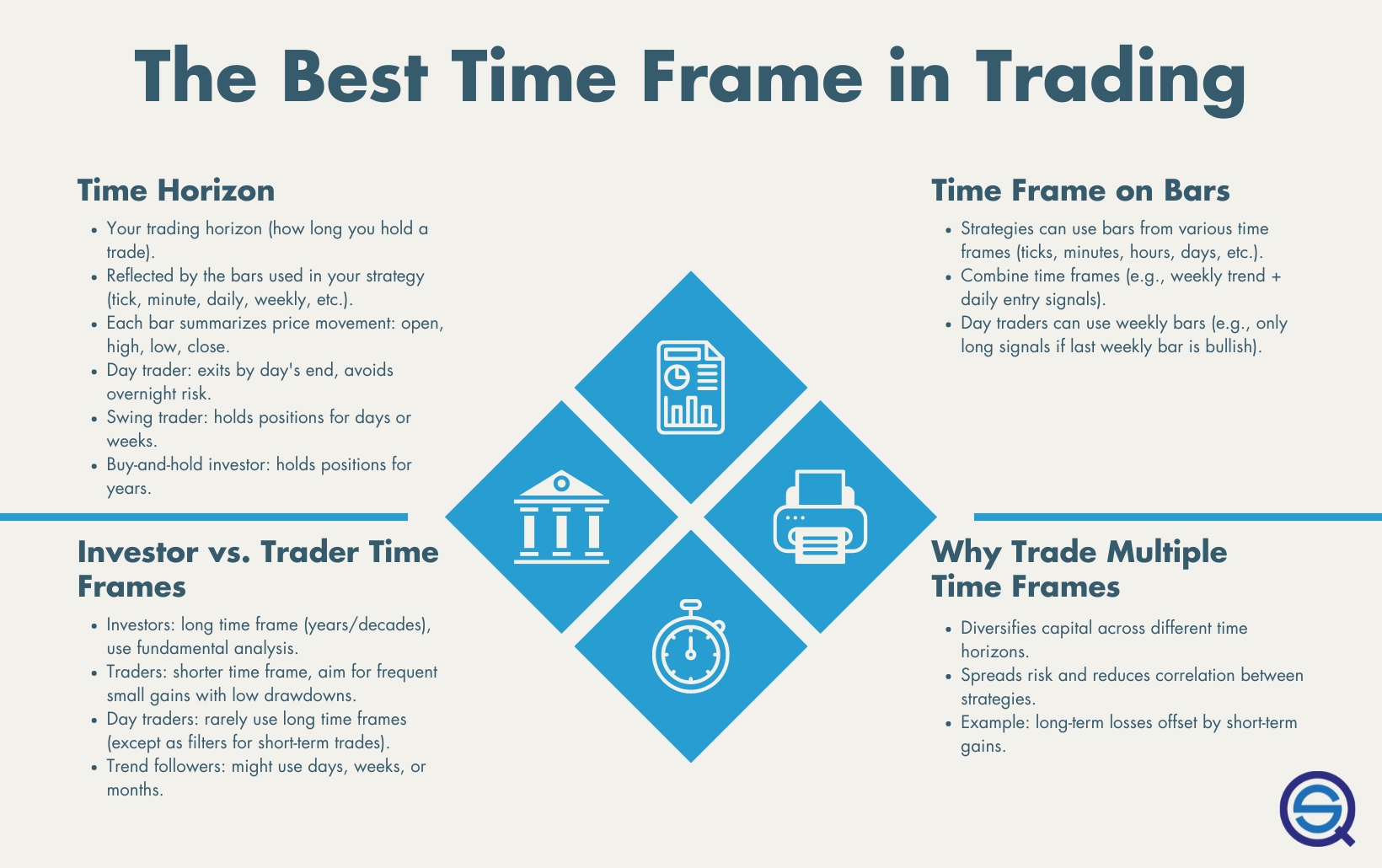

Can I use multiple timeframes for better momentum trading?

Yes, using multiple timeframes can enhance momentum trading. Start with a higher timeframe, like the 1-hour chart, to identify the overall trend. Then, switch to a lower timeframe, such as the 5-minute or 15-minute chart, for entry and exit points. This strategy helps confirm momentum and improves trade accuracy. Combining different timeframes allows you to see the bigger picture while capitalizing on short-term price movements.

What Are the Best Timeframes for Day Trading Momentum Strategies?

Best timeframes for momentum day trading are typically 1-minute, 5-minute, and 15-minute charts. These shorter timeframes allow traders to capture quick price movements and identify momentum shifts effectively.

Learn more about: What Are Day Trading Momentum Strategies?

Learn about Best Timeframes for Day Trading Scalping Strategies

What is the best timeframe for beginners in day trading?

The best timeframes for beginners in momentum day trading are typically 5-minute and 15-minute charts. These timeframes allow you to spot trends and make quick decisions without being overwhelmed by market noise. Start with the 5-minute chart for entry and exit signals, while using the 15-minute chart to identify overall momentum.

How do volatility and timeframes relate in day trading?

In day trading, volatility and timeframes are closely linked. Shorter timeframes, like 1-minute or 5-minute charts, often capture higher volatility, allowing traders to exploit quick price movements. Conversely, longer timeframes, such as 15-minute or hourly charts, can smooth out volatility, providing a clearer trend but with fewer opportunities. For momentum day trading, focusing on 5-minute to 15-minute charts usually strikes a balance, offering enough volatility to capitalize on price swings while still allowing for effective trade management.

When should I switch timeframes while day trading?

Switch timeframes when you notice a shift in market momentum or when your current timeframe isn’t providing clear signals. For momentum day trading, use shorter timeframes, like 1-minute or 5-minute charts, for entry and exit points. Switch to a longer timeframe, like 15 or 30 minutes, to identify overall trends and avoid false signals. If price action becomes erratic or your strategy fails to align with market behavior, it’s time to adjust.

How can I combine timeframes for momentum trading strategies?

To combine timeframes for momentum trading, start with a higher timeframe, like the 1-hour or 4-hour chart, to identify the overall trend. Then, use a lower timeframe, such as the 15-minute or 5-minute chart, to pinpoint entry and exit points. Look for alignment between both timeframes; for example, if the 4-hour trend is bullish, focus on buying opportunities on the 15-minute chart. This approach enhances trade accuracy and helps manage risk effectively.

What are the risks of using shorter timeframes in day trading?

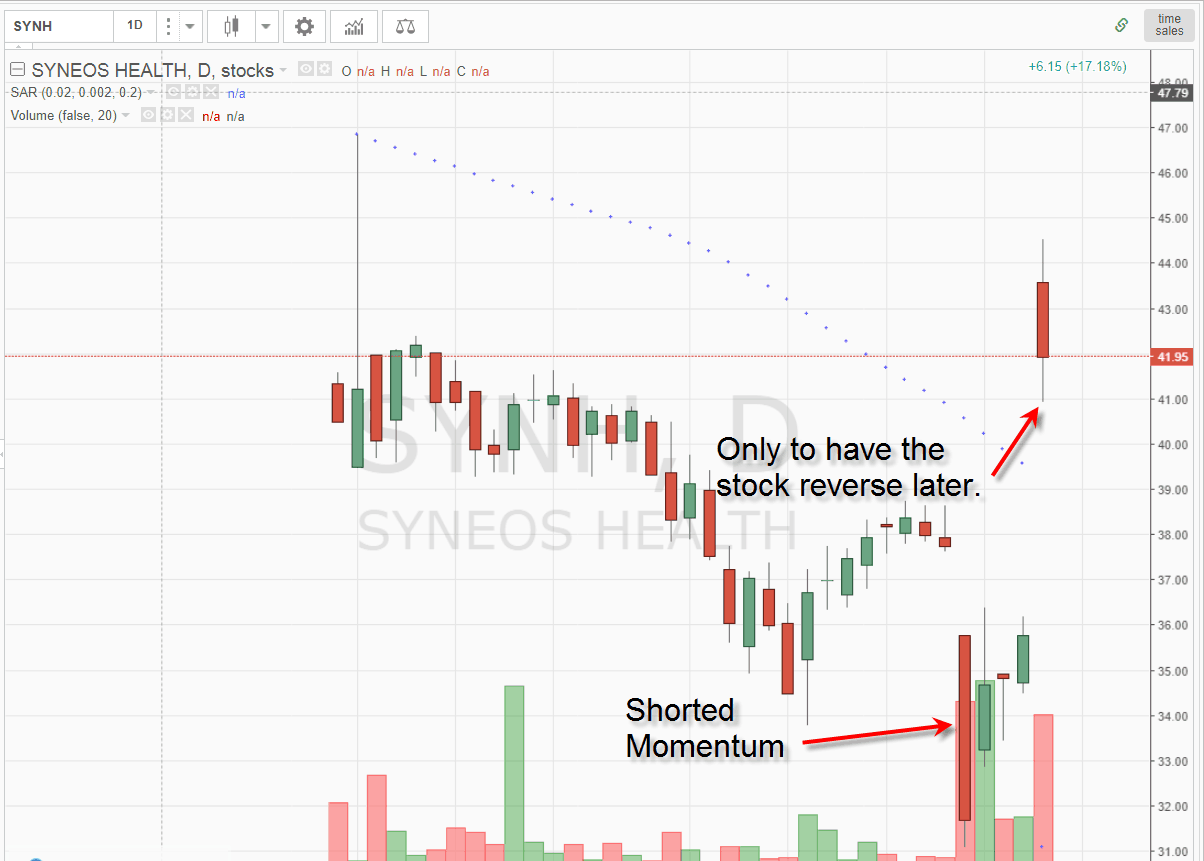

Using shorter timeframes in day trading can increase risks due to heightened volatility and noise, making it easier to misinterpret price movements. You might face more false signals, leading to impulsive decisions and increased trading costs from frequent transactions. Additionally, tighter stop-loss levels can result in quicker losses if the market moves against you. Lastly, emotional stress can escalate, as rapid fluctuations demand constant attention and quick reactions.

How does market news affect the choice of trading timeframes?

Market news significantly influences the choice of trading timeframes for momentum day trading. Traders often prefer shorter timeframes, like 1-minute or 5-minute charts, to capitalize on quick price movements triggered by news events. For example, earnings reports or economic indicators can lead to rapid volatility, making intraday trading more appealing.

In contrast, significant news can also lead to extended periods of uncertainty, prompting traders to opt for slightly longer timeframes, such as 15 or 30 minutes, to filter out noise. Ultimately, staying updated on news releases helps traders align their strategies with market sentiment, ensuring they choose the most effective timeframe for their trades.

Learn about How to Stay Updated on Crypto Market News for Day Trading

What timeframe is recommended for swing trading compared to day trading?

Swing trading typically uses a timeframe of a few days to a couple of weeks, focusing on capturing short-term market moves. In contrast, day trading involves executing trades within a single day, often holding positions for minutes to hours. For momentum day trading, traders often look at 1-minute to 15-minute charts to make quick decisions based on rapid price movements.

Conclusion about Best Timeframes for Momentum Day Trading

In conclusion, selecting the right timeframe is crucial for successful momentum day trading. Whether you prefer the rapid insights of the 1-minute chart or the broader perspective of the hourly chart, each timeframe offers distinct advantages that can enhance your trading strategy. Understanding how to effectively combine multiple timeframes can lead to better decision-making and improved trade execution. For tailored guidance and in-depth insights on day trading, consider leveraging the resources available through DayTradingBusiness.

Learn about Best Timeframes for Day Trading Scalping Strategies

Sources:

- A Profitable Day Trading Strategy For The U.S. Equity Market by ...

- Foreign institutions, local investors and momentum trading ...

- Predicting market movement direction for bitcoin: A comparison of ...

- The Predictive Power of Inter-trade Durations: Return Reversals and ...

- Unraveling the Dynamics of SPY Trading Volumes: A ...

- History matters: How short-term price charts hurt investment ...