Did you know that some traders believe wearing lucky socks can lead to better trades? While superstition might add a little fun, effective risk management is the real key to success in momentum day trading. In this article, we’ll explore essential techniques that every trader needs to implement, including identifying risk tolerance, the critical role of stop-loss orders, and the importance of position sizing. We’ll also discuss how to use risk-reward ratios, avoid common pitfalls, and leverage diversification. Furthermore, emotional discipline and a well-defined trading plan can significantly enhance your risk management strategies. With the right tools and an understanding of market volatility, traders can not only protect their capital but also improve their performance. Dive in with DayTradingBusiness to discover how to mitigate losses and refine your approach through backtesting for a more resilient trading strategy.

What are the best risk management techniques for momentum day traders?

The best risk management techniques for momentum day traders include:

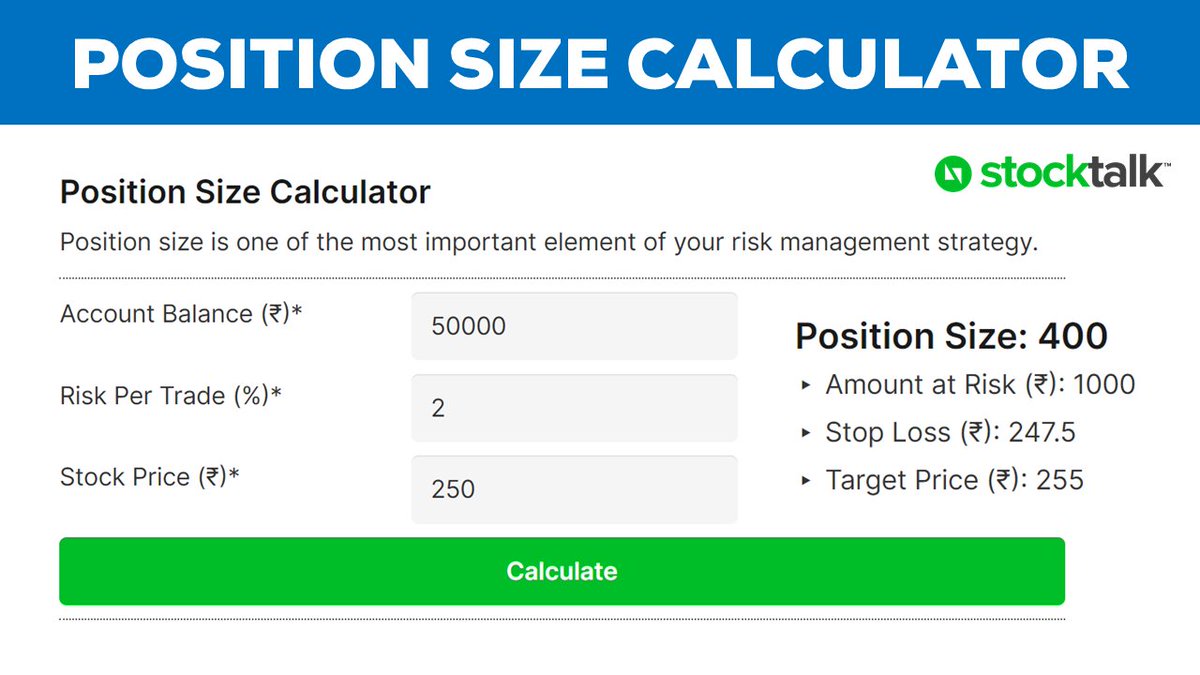

1. Position Sizing: Use a fixed percentage of your trading capital for each trade, typically 1-3%, to limit losses.

2. Stop-Loss Orders: Set stop-loss orders to minimize losses on each trade, ideally at 1-2% below your entry point.

3. Risk-Reward Ratio: Aim for a minimum risk-reward ratio of 1:2, ensuring potential profits outweigh potential losses.

4. Diversification: Avoid concentrating too much capital in one trade or sector; spread your risk across multiple trades.

5. Daily Loss Limit: Establish a maximum daily loss limit to prevent emotional trading; if reached, stop trading for the day.

6. Trailing Stops: Use trailing stops to lock in profits as a trade moves in your favor, while still allowing for upside potential.

7. Market Conditions Assessment: Regularly evaluate market trends and volatility, adapting your strategies accordingly to manage risks effectively.

Implementing these techniques can help momentum day traders protect their capital and enhance their overall trading performance.

How can day traders identify their risk tolerance?

Day traders can identify their risk tolerance by assessing their financial situation, experience level, and emotional response to losses. Start by determining how much capital you can afford to lose without impacting your lifestyle. Next, evaluate your trading experience—novices may need to adopt a more conservative approach. Finally, reflect on your emotional reactions to market fluctuations; if you feel anxious during downturns, you might need to lower your position sizes. Use tools like stop-loss orders to enforce your risk limits and track your performance to adjust your strategies as needed.

What role does stop-loss play in day trading risk management?

Stop-loss orders are crucial in day trading risk management as they limit potential losses on trades. By setting a predetermined price at which to exit a losing position, traders protect their capital and prevent emotional decision-making during market fluctuations. This strategy helps maintain a favorable risk-to-reward ratio, ensuring that losses are controlled while allowing for upside potential. Essentially, a stop-loss acts as a safety net, enabling traders to focus on momentum strategies without the constant fear of significant losses.

How should traders set their stop-loss orders effectively?

Traders should set stop-loss orders based on their risk tolerance and the stock's volatility. A common method is to place the stop-loss 1-2% below the entry price for tight control. For more volatile stocks, consider using a percentage based on the average true range (ATR) to allow for natural price fluctuations. Always adjust the stop-loss as the trade moves in your favor to lock in profits. Additionally, avoid placing stop-loss orders at obvious price levels that could be easily triggered by market noise.

What is position sizing and why is it important for day traders?

Position sizing refers to determining the amount of capital to allocate to a particular trade based on your total account size and risk tolerance. It’s crucial for day traders because it helps manage risk, ensuring that no single trade can significantly impact the overall portfolio. By controlling position size, traders can limit losses, maintain consistency, and capitalize on profitable opportunities without overexposing their capital. Proper position sizing is key to longevity in day trading.

How can traders use risk-reward ratios to manage their trades?

Traders can use risk-reward ratios to manage their trades by determining how much they are willing to risk on a trade compared to the potential reward. For example, if a trader risks $100 to potentially gain $300, the risk-reward ratio is 1:3.

By setting this ratio before entering a trade, traders can make informed decisions on position sizing, stop-loss placements, and profit targets. Maintaining a favorable risk-reward ratio helps ensure that even with a lower win rate, overall profitability is achievable. Adjusting trades based on these ratios allows traders to minimize losses and maximize gains effectively.

What are the common mistakes in risk management for day traders?

Common mistakes in risk management for day traders include:

1. Ignoring Stop Losses: Failing to set stop losses can lead to significant losses. Always define your exit point before entering a trade.

2. Overleveraging: Using too much leverage increases risk. Stick to a manageable position size to protect your capital.

3. Emotional Trading: Making decisions based on fear or greed can derail your strategy. Stay disciplined and follow your plan.

4. Inadequate Risk-Reward Ratio: Not assessing the risk-reward ratio can result in unprofitable trades. Aim for at least a 1:2 ratio.

5. Lack of Diversification: Concentrating too much on one stock can expose you to higher risk. Diversify to spread the risk across different trades.

6. Neglecting Market Conditions: Ignoring broader market trends can lead to poor timing. Always consider the overall market context before making trades.

7. Not Reviewing Trades: Failing to analyze past trades prevents learning from mistakes. Regularly review your trades to identify patterns and improve.

8. Overtrading: Trading too frequently can increase costs and stress. Stick to your strategy and avoid unnecessary trades.

By addressing these mistakes, day traders can enhance their risk management and improve their overall performance.

How does diversification help in day trading risk management?

Diversification in day trading helps manage risk by spreading investments across various assets or sectors, reducing the impact of a poor-performing trade. When one position loses, others may gain, balancing overall performance. It also minimizes exposure to volatility in any single stock. For momentum traders, diversifying into stocks with different momentum profiles can capture gains while limiting downside risk. This approach allows traders to maintain a more stable portfolio and avoid significant losses.

What tools can momentum traders use for risk management?

Momentum traders can use several tools for effective risk management:

1. Stop-Loss Orders: Set predefined exit points to limit losses on trades.

2. Position Sizing: Calculate the appropriate amount to invest in each trade based on risk tolerance.

3. Trailing Stops: Adjust stop-loss levels as the trade moves in your favor to protect profits.

4. Risk-Reward Ratio: Analyze potential gains against losses to ensure favorable trade setups.

5. Volatility Indicators: Utilize tools like the Average True Range (ATR) to gauge market volatility and adjust strategies accordingly.

6. Diversification: Spread investments across multiple assets to reduce exposure to any single trade.

Implementing these tools can help momentum traders manage risk effectively while pursuing opportunities.

How can emotional discipline enhance risk management in trading?

Emotional discipline enhances risk management in trading by helping traders stick to their plans and avoid impulsive decisions. When emotions run high, traders might ignore stop-loss orders or chase losing positions. A disciplined approach ensures adherence to strategies, maintaining consistency even during volatile market conditions. This control reduces the likelihood of emotional trading, allowing for better risk assessment and position sizing. Ultimately, emotional discipline leads to more rational decision-making, helping traders protect their capital and improve long-term profitability.

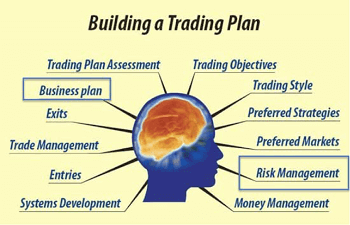

Why is having a trading plan crucial for risk management?

A trading plan is crucial for risk management because it provides clear guidelines for entering and exiting trades, helping to minimize emotional decision-making. It establishes risk tolerance levels, ensuring you don’t overexpose your capital. With defined strategies, such as stop-loss orders, you can limit potential losses and protect profits. A solid trading plan also fosters discipline, keeping you focused on your strategy rather than reacting to market fluctuations. Ultimately, it enhances your ability to manage risk effectively, essential for momentum day traders seeking consistent profitability.

How can traders assess market volatility for better risk management?

Traders can assess market volatility using several techniques. First, they can monitor the Average True Range (ATR) to gauge price movement over time. Second, the VIX index provides insights into expected market volatility. Third, analyzing historical price swings helps identify patterns in volatility. Additionally, traders can use Bollinger Bands to visualize price volatility and potential breakouts. Finally, keeping an eye on economic news and events can indicate periods of heightened volatility. By combining these tools, traders can adjust their strategies and position sizes for effective risk management.

What is the impact of trading psychology on risk management?

Trading psychology significantly impacts risk management for momentum day traders. Emotional factors like fear and greed can cloud judgment, leading to impulsive decisions and increased risk. A trader's mindset influences their ability to stick to stop-loss orders and maintain discipline during volatile markets. For instance, overconfidence might result in larger positions than warranted, while anxiety could prompt premature exits. Developing a solid trading plan and adhering to it can help mitigate these psychological pitfalls, ensuring more effective risk management and better trading outcomes.

How can day traders adjust their strategies in volatile markets?

Day traders can adjust their strategies in volatile markets by implementing tighter stop-loss orders to limit potential losses. Increasing position size can amplify gains but should be approached cautiously. Traders should also focus on high-probability setups, using technical indicators like moving averages to identify trend reversals. Reducing the number of trades can help maintain focus and improve decision-making. Additionally, incorporating a trailing stop can lock in profits while allowing room for further gains. Lastly, staying informed on market news and economic indicators can help traders anticipate volatility shifts.

What Are Effective Risk Management Techniques for Day Trading Momentum Strategies?

Day trading momentum strategies involve buying stocks that are trending up and selling those that are trending down, aiming to capitalize on short-term price movements. Key risk management techniques for momentum day traders include setting stop-loss orders to limit losses, diversifying trades to mitigate risk, using position sizing to control exposure, and regularly reviewing performance to adjust strategies accordingly.

Learn more about: What Are Day Trading Momentum Strategies?

Learn about Effective Risk Management for Scalping in Day Trading

What techniques can help mitigate losses in day trading?

To mitigate losses in day trading, consider these techniques:

1. Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade. This ensures you exit positions before losses escalate.

2. Position Sizing: Determine the size of each trade based on your overall capital and risk tolerance. Avoid risking more than 1-2% of your account on a single trade.

3. Diversification: Avoid concentrating your trades in a single stock or sector. Spread your investments to minimize risk.

4. Regularly Review Trades: Analyze past trades to identify patterns in your losses. Learning from mistakes helps improve future decision-making.

5. Use a Trading Plan: Create a detailed trading plan outlining entry and exit strategies, risk management rules, and performance goals. Stick to it.

6. Stay Informed: Keep up with market news and trends that could impact your trades. Being informed helps in making timely decisions.

7. Limit Trading Frequency: Avoid overtrading. Set a maximum number of trades per day to maintain focus and reduce emotional strain.

8. Practice Discipline: Stick to your strategy even in volatile markets. Emotional trading often leads to losses.

Implementing these techniques can enhance your risk management and help reduce losses in day trading.

How can backtesting improve risk management strategies for traders?

Backtesting allows traders to evaluate their risk management strategies by simulating past market conditions. It helps identify which techniques effectively limit losses and maximize gains. By analyzing historical data, traders can refine stop-loss orders, position sizing, and entry/exit strategies. This process reveals potential weaknesses in a strategy before real capital is risked, leading to more informed decision-making. Ultimately, backtesting enhances confidence and adaptability in volatile markets, crucial for momentum day traders.

Conclusion about Risk Management Techniques for Momentum Day Traders

Incorporating effective risk management techniques is vital for successful momentum day trading. By identifying risk tolerance, setting appropriate stop-loss orders, and understanding position sizing, traders can safeguard their capital while maximizing potential gains. Tools and strategies such as risk-reward ratios, diversification, and emotional discipline further enhance overall trading performance. Continuous assessment of market volatility and backtesting can refine these strategies, enabling traders to adapt to changing conditions. For comprehensive support and insights tailored to your trading journey, consider the expertise offered by DayTradingBusiness.

Learn about Risk Management Techniques for Futures Day Traders