Did you know that the term "reversal" in trading might sound like a wrestling move, but it’s actually a powerful risk management strategy? In this article, we’ll explore the ins and outs of reversal strategies, detailing how they function and their benefits in trading. You’ll learn how to effectively identify reversal patterns, implement them into your trading plan, and minimize associated risks. We’ll also discuss essential indicators to spot reversal signals, the impact of market conditions, and common pitfalls to avoid. Plus, get insights on how psychology plays a role in reversal trading and how to adapt your strategy across different asset classes. With the expertise from DayTradingBusiness, you'll be equipped to navigate the world of reversal strategies confidently.

What are reversal strategies in risk management?

Reversal strategies in risk management involve taking positions that are opposite to existing investments to mitigate potential losses. For example, if you hold a long position in an asset, you might buy put options or short the asset to hedge against a downturn. This approach helps protect your portfolio from adverse market movements while allowing you to maintain your initial investment. Key aspects include identifying your risk exposure, choosing appropriate instruments, and regularly adjusting your strategy based on market conditions.

How do reversal strategies work in trading?

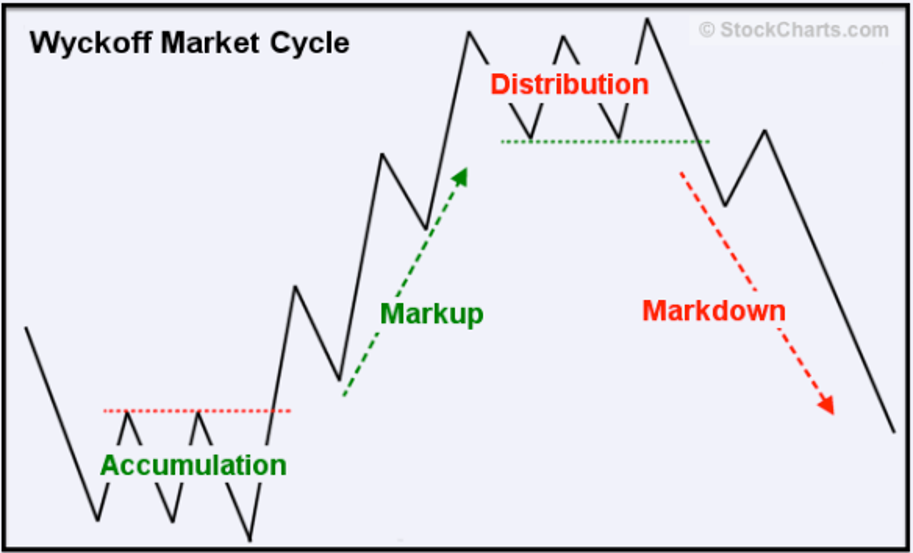

Reversal strategies in trading focus on identifying price points where a trend is likely to change direction. Traders look for signs of exhaustion in the current trend, such as overbought or oversold conditions, using indicators like RSI or MACD.

To manage risk, set clear stop-loss orders just beyond the reversal point to limit potential losses. Position sizing is crucial—only risk a small percentage of your capital on each trade.

Monitor market conditions and adjust your strategy as needed, ensuring you’re not overly reliant on any single indicator. Use limit orders to enter trades at optimal prices, increasing your chances of success while controlling risk effectively.

What are the benefits of using reversal strategies?

Reversal strategies help manage risk by allowing traders to capitalize on market reversals, reducing potential losses. They provide a clear exit strategy, enabling quick adjustments to positions when trends shift. By using reversal strategies, traders can enhance their risk-reward ratio, maintaining profitability even in volatile markets. Additionally, these strategies promote disciplined trading, encouraging traders to stick to their plans and avoid emotional decisions. Overall, reversal strategies offer a structured approach to navigating market fluctuations effectively.

How can I identify reversal patterns effectively?

To identify reversal patterns effectively, focus on key indicators such as price action, volume, and trendlines. Look for formations like head and shoulders, double tops, and bottoms. Analyze candlestick patterns, such as engulfing or hammer formations, which signal potential reversals. Use oscillators like RSI or MACD to spot overbought or oversold conditions that may indicate a reversal. Confirm patterns with volume spikes; increased volume often validates a reversal. Lastly, set clear risk management strategies, like stop-loss orders, to protect your capital when trading these patterns.

What types of reversal strategies are commonly used?

Common reversal strategies include:

1. Long Put Reversal: Buying a put option while simultaneously selling a stock short. This hedges against a stock's decline.

2. Short Call Reversal: Selling a call option while holding a long position in the underlying stock. This can generate income in a sideways market.

3. Iron Condor: Combining a short call spread and a short put spread to profit from low volatility within a defined range.

4. Collar: Holding a long stock position while buying a protective put and selling a call to limit downside risk.

5. Reverse Iron Condor: Buying both a call and a put at different strike prices while selling a narrower range to profit from high volatility.

These strategies help manage risk and can enhance returns in various market conditions.

How do I implement a reversal strategy in my trading plan?

To implement a reversal strategy in your trading plan, follow these steps:

1. Identify Key Levels: Look for support and resistance levels where price action often reverses.

2. Use Indicators: Incorporate indicators like RSI or MACD to spot overbought or oversold conditions.

3. Set Entry Points: Plan entry points near these key levels, watching for signs of a reversal, like candlestick patterns.

4. Establish Risk Management: Set stop-loss orders just beyond your entry point to limit losses.

5. Define Profit Targets: Determine your exit points based on historical price action or risk-reward ratios.

6. Test and Adjust: Backtest your strategy on historical data, then adjust based on performance and market conditions.

7. Stay Disciplined: Stick to your plan, avoiding emotional decisions during trades.

By focusing on these core steps, you can effectively manage risk and implement a reversal strategy in your trading.

What risks are associated with reversal strategies?

Reversal strategies carry several risks, including market volatility, execution risk, and potential for significant losses. If the market moves against your position, losses can accumulate quickly. Additionally, timing is critical; entering or exiting at the wrong moment can exacerbate losses. Liquidity risk also exists, as you might struggle to execute trades at desired prices. Furthermore, psychological factors can lead to emotional decision-making, impacting strategy effectiveness. To manage these risks, set clear stop-loss orders, maintain proper position sizes, and stay informed about market conditions.

How can I minimize risks when using reversal strategies?

To minimize risks when using reversal strategies, start by setting strict stop-loss orders to limit potential losses. Diversify your positions to avoid overexposure to a single asset. Use lower leverage to reduce the impact of adverse price movements. Continuously monitor market conditions and adjust your strategy as needed. Incorporate technical analysis to identify optimal entry and exit points. Regularly review your performance and refine your approach based on past outcomes. Stay disciplined and avoid emotional trading decisions.

How Can I Manage Risk When Using Day Trading Reversal Strategies?

To manage risk with reversal strategies in day trading, use these steps:

1. **Set Stop-Loss Orders**: Always place stop-loss orders to limit potential losses.

2. **Position Sizing**: Determine the size of your trades based on your risk tolerance, usually not exceeding 1-2% of your capital.

3. **Diversify Trades**: Avoid concentration in a single asset to spread risk.

4. **Use Technical Indicators**: Employ indicators like RSI or MACD to confirm reversal signals.

5. **Monitor Market Conditions**: Stay aware of overall market trends and news that could impact reversals.

6. **Plan Exit Strategies**: Define profit-taking levels in advance to secure gains and minimize emotional decision-making.

Implementing these risk management techniques can enhance the effectiveness of your reversal strategies.

Learn more about: Understanding Day Trading Reversal Strategies

What indicators can help spot reversal signals?

To spot reversal signals, look for these key indicators:

1. Candlestick Patterns: Patterns like hammers, shooting stars, or engulfing patterns often signal a reversal.

2. Divergence: When the price moves in one direction but indicators like RSI or MACD move in the opposite direction, it suggests a potential reversal.

3. Support and Resistance Levels: Price bouncing off established support or resistance levels can indicate a reversal.

4. Volume Changes: A spike in volume during a price change can signal strength behind a potential reversal.

5. Trendline Breaks: A break of a defined trendline can indicate that the current trend may be reversing.

6. Moving Averages: Crossovers between short-term and long-term moving averages can indicate a shift in trend direction.

Use these indicators to enhance your reversal strategies and manage risk effectively.

How do market conditions affect reversal strategies?

Market conditions significantly impact reversal strategies. In volatile markets, price swings can trigger more frequent reversals, which may lead to higher profits but also increased risk. In trending markets, reversal strategies may struggle as prices continue in one direction, potentially resulting in losses.

To manage risk, use stop-loss orders to limit potential losses and position sizing to control exposure. Analyze market indicators like momentum and support/resistance levels to identify optimal reversal points. Adapting your strategy to current market conditions can enhance effectiveness and mitigate risks.

What are common mistakes to avoid with reversal strategies?

Common mistakes to avoid with reversal strategies include:

1. Ignoring Market Conditions: Always consider the current market trend; reversal strategies work best in specific conditions.

2. Over-leveraging: Using too much leverage can amplify losses; keep your position sizes manageable.

3. Lack of Stop Losses: Failing to set stop losses can lead to significant losses if the market moves against you.

4. Emotional Trading: Making decisions based on fear or greed can derail your strategy; stick to your plan.

5. Inadequate Research: Not analyzing the underlying asset can lead to poor entries; always conduct thorough analysis before acting.

6. Neglecting Risk Management: Failing to assess risk-reward ratios can result in taking on unmanageable risks.

7. Chasing the Market: Entering trades after a significant move can lead to losses; wait for confirmation of the reversal.

Avoid these pitfalls to enhance your effectiveness with reversal strategies.

How can I backtest a reversal strategy before applying it?

To backtest a reversal strategy, follow these steps:

1. Define Your Criteria: Establish clear entry and exit points, including indicators like RSI or support/resistance levels.

2. Select a Backtesting Platform: Use software like TradingView, MetaTrader, or Python libraries like Backtrader.

3. Gather Historical Data: Obtain price data for the assets you want to test, ensuring it covers various market conditions.

4. Run the Backtest: Input your strategy criteria into the platform and execute the backtest to simulate trades over the historical data.

5. Analyze the Results: Review key metrics such as win rate, average return per trade, maximum drawdown, and overall profitability.

6. Adjust Your Strategy: Based on the results, tweak your criteria to optimize performance while managing risk.

7. Paper Trade: Test the strategy in real-time with a demo account to validate it before applying real capital.

What role does psychology play in reversal trading?

Psychology plays a crucial role in reversal trading by influencing decision-making and emotional responses. Traders often experience fear and greed, which can lead to premature exits or holding onto losing positions. A solid understanding of market psychology helps traders identify when a reversal is likely, allowing them to manage risk effectively. For instance, recognizing signs of market exhaustion can aid in making informed entries. Additionally, maintaining discipline and sticking to a trading plan is vital to avoid impulsive trades driven by emotional reactions.

How do reversal strategies compare to trend-following strategies?

Reversal strategies aim to capitalize on price corrections after trends, while trend-following strategies seek to profit from sustained market movements. Reversal strategies often involve higher risk due to potential false signals, whereas trend-following strategies can provide more consistent returns by aligning with market momentum. Managing risk with reversal strategies typically requires tighter stop-loss orders and careful analysis of market conditions, unlike trend-following, which may use broader stop-loss levels. In essence, reversal strategies depend on timing and market reversals, while trend-following relies on momentum and sustained price movements.

What are some real-life examples of successful reversal strategies?

1. Options Trading: Investors often use reversal strategies in options trading by implementing a long put option while simultaneously holding a short position on the underlying asset. This approach can mitigate losses if the market moves against the initial position.

2. Stock Market: A well-known example is when a trader buys a declining stock, anticipating a rebound. For instance, during the 2008 financial crisis, some investors bought shares of undervalued banks, successfully profiting when the market recovered.

3. Currency Markets: Traders might enter a long position in a currency pair after a significant drop, betting on a reversal. For example, when the Euro dipped sharply against the Dollar, some traders went long, capitalizing on the subsequent recovery.

4. Real Estate: Investors in real estate may buy properties in distressed areas, expecting appreciation as the market improves. Successful examples include urban renewal projects where investors saw significant returns as neighborhoods revitalized.

5. Commodity Markets: A farmer might hedge against falling prices by selling futures contracts while holding physical commodities. If prices rise, the farmer can benefit from both the futures and the physical sale, effectively reversing potential losses.

How can I adapt my reversal strategy to different asset classes?

To adapt your reversal strategy across different asset classes, first, understand the specific characteristics of each asset. For stocks, focus on volatility and earnings reports; adjust your entry and exit points based on price action and support/resistance levels. For options, consider implied volatility and time decay, employing strategies like straddles or strangles when market conditions are favorable.

In forex, monitor economic indicators and geopolitical events that affect currency pairs, using tighter stop-loss orders. For commodities, stay alert to supply-demand dynamics and seasonal trends, adjusting your strategy to account for these factors. Always backtest your approach in each asset class and refine based on performance.

Conclusion about How to Manage Risk with Reversal Strategies

Incorporating reversal strategies into your trading plan can significantly enhance your risk management approach. By effectively identifying reversal patterns and leveraging key indicators, traders can navigate market fluctuations with greater confidence. However, it's crucial to remain aware of the associated risks and pitfalls. Continuous evaluation and backtesting of your strategies, along with a clear understanding of market conditions, will further bolster your trading success. For tailored guidance and expert insights on navigating these strategies, DayTradingBusiness is here to support your journey.