Did you know that the average day trader spends more time staring at charts than most people do in a week? In the fast-paced world of day trading scalping, mastering technical analysis is key to making quick, informed decisions. This article dives deep into the essentials of technical analysis for scalping, covering everything from choosing the best indicators and time frames to identifying support and resistance levels. You'll learn how to effectively use chart patterns, moving averages, and candlestick patterns, as well as the significance of volume in your trades. Additionally, we’ll explore risk management strategies, common pitfalls to avoid, and the impact of news on your scalping tactics. With insights on backtesting and developing a robust scalping strategy, this guide by DayTradingBusiness equips you with the tools needed to sharpen your trading skills and maximize your success.

What is technical analysis in day trading scalping?

Technical analysis in day trading scalping involves using charts and indicators to identify short-term price movements. Traders analyze patterns, trends, and key levels, focusing on tools like moving averages, RSI, and Bollinger Bands. The goal is to make quick trades based on price action, aiming for small profits from rapid fluctuations. Understanding support and resistance levels is crucial, as it helps in determining entry and exit points. Successful scalpers rely on real-time data and execute trades swiftly to capitalize on minor price changes.

How do I choose the best indicators for scalping?

To choose the best indicators for scalping, focus on those that provide quick, actionable insights. Popular choices include:

1. Moving Averages: Use short-term moving averages (like the 5 or 10-period) to identify trends rapidly.

2. Relative Strength Index (RSI): Look for overbought or oversold conditions to spot entry and exit points.

3. Bollinger Bands: Utilize them to gauge volatility and potential price reversals.

4. Volume Indicators: Monitor volume spikes to confirm price movements and validate breakouts.

5. MACD: Use it to identify momentum shifts and potential trade entries.

Combine these indicators to enhance your analysis and ensure they align with your trading strategy and risk tolerance. Test them on a demo account to find what works best for you.

What time frames are best for day trading scalping?

The best time frames for day trading scalping are typically 1-minute and 5-minute charts. These shorter time frames allow for quick entries and exits, capturing small price movements. Traders often use 15-minute charts for additional trend confirmation, but the focus remains on the rapid trades seen in 1-minute and 5-minute intervals.

How can I identify support and resistance levels for scalping?

To identify support and resistance levels for scalping, start by analyzing price charts, focusing on short timeframes like 5 or 15 minutes. Look for historical price points where the market has reversed—these are your support (price floor) and resistance (price ceiling) levels. Use tools like trendlines and moving averages to visualize these levels. Additionally, pay attention to psychological levels, such as round numbers, where traders often place buy or sell orders. Volume spikes can also indicate strong support or resistance. Regularly update your levels as the market evolves to maintain accuracy.

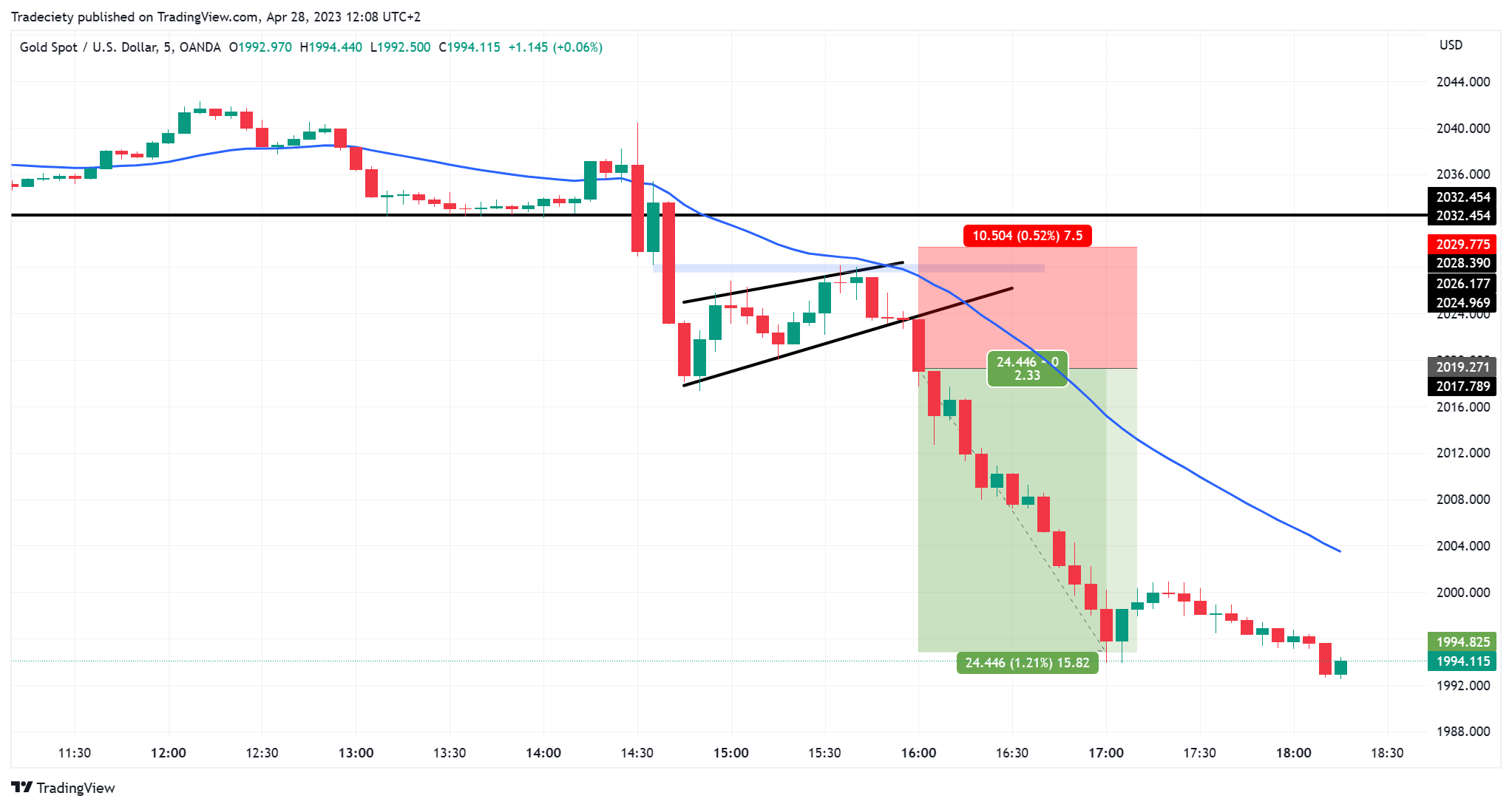

What role do chart patterns play in scalping strategies?

Chart patterns are crucial in scalping strategies because they help traders identify short-term price movements and potential reversals. Patterns like flags, triangles, and head-and-shoulders signal entry and exit points, allowing scalpers to capitalize on quick price changes. Recognizing these patterns can enhance decision-making, increase trade accuracy, and improve profit margins in the fast-paced scalping environment.

How do I use moving averages for scalping effectively?

To use moving averages for scalping effectively, follow these steps:

1. Choose Short-Term Averages: Use short-term moving averages like the 5-period and 20-period. They react quickly to price changes.

2. Identify Crossovers: Look for crossovers where the shorter moving average crosses above or below the longer one. A bullish crossover can signal a buy, while a bearish crossover can signal a sell.

3. Set Entry and Exit Points: Enter trades on crossovers and set tight stop-loss orders to manage risk. Aim for small, quick profits.

4. Combine with Other Indicators: Use additional indicators like RSI or MACD to confirm signals from moving averages.

5. Monitor Timeframes: Focus on 1-minute or 5-minute charts for scalping to capture quick price movements.

6. Practice Risk Management: Only risk a small percentage of your capital on each trade to protect against losses.

7. Stay Informed: Keep an eye on market news that could impact volatility.

By focusing on these strategies, you can effectively use moving averages for scalping in day trading.

How can I apply candlestick patterns in day trading?

To apply candlestick patterns in day trading, start by identifying key patterns like doji, engulfing, and hammer on your charts. Use these patterns to anticipate price movements: for instance, a bullish engulfing pattern may signal a potential upward trend, while a bearish doji can indicate indecision or a reversal.

Combine candlestick analysis with other indicators, like moving averages or RSI, for confirmation before entering trades. Monitor volume alongside candlestick patterns; high volume can validate a pattern's strength.

Finally, practice risk management by setting stop-loss orders based on the candlestick's high or low, protecting your capital while taking advantage of these visual cues in your scalping strategy.

What is the importance of volume in scalping?

Volume is crucial in scalping because it indicates the strength of a price movement. High volume confirms trends, making it easier to enter and exit positions quickly. It shows liquidity, allowing scalpers to execute trades without significant slippage. Additionally, volume spikes can signal potential reversals or breakouts, helping scalpers make informed decisions. In short, monitoring volume helps you gauge market activity and enhance your trading strategy.

How do I set stop-loss and take-profit orders for scalping?

To set stop-loss and take-profit orders for scalping, first determine your entry point based on technical analysis. Identify key support and resistance levels.

For stop-loss, place it just below the nearest support level to minimize losses if the trade goes against you. Typically, a stop-loss of 1-2% below your entry price is effective in scalping.

For take-profit, set it at a recent resistance level or a predefined risk-reward ratio, often aiming for 1:2 or 1:3. This ensures you capture profits quickly.

Always adjust these levels based on market volatility and your trading strategy.

What are the best trading platforms for scalping?

The best trading platforms for scalping include:

1. MetaTrader 4/5 – Popular for its advanced charting tools and custom indicators.

2. NinjaTrader – Offers fast execution and extensive analysis features.

3. Thinkorswim by TD Ameritrade – Great for its comprehensive technical analysis tools.

4. Interactive Brokers – Known for low commissions and advanced trading options.

5. TradeStation – Excellent for its powerful analysis and customizable interface.

These platforms provide the speed and analytical tools necessary for effective day trading scalping.

How can I manage risk while day trading with technical analysis?

To manage risk while day trading with technical analysis for scalping, use these strategies:

1. Set Stop-Loss Orders: Always determine a stop-loss level before entering a trade to limit potential losses.

2. Position Sizing: Calculate your position size based on your risk tolerance, ensuring no single trade risks more than 1-2% of your trading capital.

3. Use Technical Indicators: Rely on indicators like moving averages, RSI, or Bollinger Bands to identify entry and exit points, helping you make informed decisions.

4. Focus on Volatility: Trade assets with appropriate volatility for scalping, ensuring you can capture quick price movements without excessive risk.

5. Limit Leverage: Avoid high leverage; it can amplify losses. Stick to lower leverage to maintain control over your trades.

6. Stay Disciplined: Follow your trading plan strictly. Avoid emotional trading, which can lead to increased risk.

7. Review and Adjust: Regularly analyze your trades to identify patterns in losses and successes, adjusting your strategy accordingly.

Implementing these techniques can help you manage risk effectively while using technical analysis for day trading scalping.

Learn about How to Use Technical Analysis for Options Day Trading

What are common mistakes to avoid in scalping?

Common mistakes to avoid in scalping include:

1. Ignoring Technical Analysis: Don’t skip chart patterns and indicators. Use them to make informed decisions.

2. Overtrading: Avoid taking too many trades. Stick to your strategy and only trade when conditions align.

3. Neglecting Risk Management: Always set stop-loss orders. Protect your capital to prevent large losses.

4. Emotional Trading: Don’t let fear or greed drive your decisions. Stay disciplined and stick to your plan.

5. Poor Timing: Enter and exit trades at the wrong moments. Use precise timing based on market signals.

6. Chasing Losses: Don’t try to recover losses by increasing position sizes. This often leads to bigger losses.

7. Lack of Preparation: Always be ready before the market opens. Review your strategy and the stocks you plan to trade.

8. Ignoring Market Conditions: Be aware of news and events that can impact volatility. Adjust your strategy accordingly.

9. Trading Without a Plan: Have a clear scalping strategy. Know your entry and exit points before executing trades.

10. Using Inadequate Tools: Ensure you have a reliable trading platform and fast internet. Lagging tools can lead to missed opportunities.

How do I develop a scalping strategy using technical analysis?

To develop a scalping strategy using technical analysis, follow these steps:

1. Choose the Right Market: Focus on highly liquid markets, such as forex or major stocks, to ensure quick entry and exit.

2. Select Time Frames: Use short time frames like 1-minute or 5-minute charts for precise entries.

3. Identify Key Indicators: Utilize indicators like moving averages, Bollinger Bands, and RSI to spot trends and reversals.

4. Set Entry and Exit Points: Determine clear entry points based on your indicators and set tight stop-loss orders to manage risk.

5. Practice Risk Management: Limit your risk to a small percentage of your trading capital on each trade.

6. Backtest Your Strategy: Test your scalping strategy on historical data to refine it before live trading.

7. Stay Disciplined: Stick to your plan and avoid emotional trading decisions.

Implement these steps to create an effective scalping strategy with technical analysis.

Learn about How to Develop Your Own Scalping Strategy for Day Trading

How can I use trend lines for scalping decisions?

To use trend lines for scalping decisions, start by identifying the trend direction on a shorter timeframe, like 1-minute or 5-minute charts. Draw trend lines connecting recent highs or lows to visualize support and resistance levels.

Enter a trade when the price approaches these trend lines, looking for a bounce off the support or resistance. Set tight stop-loss orders just outside the trend line to manage risk. Use the trend line to determine exit points; aim for small, quick profits as the price moves within the trend. Always confirm with other indicators to increase the reliability of your scalping decisions.

What is the impact of news on scalping strategies?

News significantly impacts scalping strategies by causing sudden price movements. Traders often react quickly to news events, leading to increased volatility. Scalpers can capitalize on these rapid price changes, entering and exiting trades within minutes. For effective scalping, it's crucial to monitor economic calendars and news feeds to anticipate market reactions. Keeping an eye on major announcements, like earnings reports or economic data releases, can help traders make informed decisions and maximize gains.

What Are the Best Technical Analysis Techniques for Day Trading Scalping?

The best day trading scalping strategies using technical analysis include:

1. **Moving Averages**: Use short-term moving averages (like the 5 and 10 EMA) to identify entry and exit points.

2. **Bollinger Bands**: Trade when prices touch the bands; buy at the lower band and sell at the upper band.

3. **RSI (Relative Strength Index)**: Look for overbought or oversold conditions (above 70 or below 30) to enter trades.

4. **MACD (Moving Average Convergence Divergence)**: Use MACD crossovers for buy or sell signals.

5. **Support and Resistance Levels**: Identify key levels to set entry and exit points based on price action.

Implement these strategies with strict risk management for effective day trading scalping.

Learn more about: What Are the Best Day Trading Scalping Strategies?

Learn about Day Trading Futures: A Guide to Technical Analysis

How do I backtest my scalping strategy effectively?

To backtest your scalping strategy effectively, follow these steps:

1. Define Your Strategy: Clearly your entry and exit rules, including indicators and timeframes.

2. Select Historical Data: Use high-quality, granular data (1-minute or tick data) for the asset you’re trading.

3. Choose a Backtesting Tool: Use software like TradingView, MetaTrader, or specialized backtesting platforms that allow for strategy coding.

4. Run Simulations: Input your strategy into the tool and simulate trades over your selected historical period.

5. Analyze Results: Look at key metrics like win rate, profit factor, drawdown, and average trade duration to assess performance.

6. Optimize: Adjust parameters based on the results, but avoid overfitting. Ensure the strategy remains robust across different market conditions.

7. Paper Trade: Implement the strategy in a simulated environment before using real capital to validate its effectiveness further.

8. Review and Iterate: Continuously monitor performance and refine your strategy based on live trading results.

This approach ensures a thorough evaluation of your scalping strategy’s viability.

Conclusion about How to Use Technical Analysis for Day Trading Scalping

Incorporating technical analysis into day trading scalping can significantly enhance your trading effectiveness. By understanding key indicators, time frames, and market dynamics, you can identify profitable opportunities while managing risks. Utilizing tools like moving averages, candlestick patterns, and support and resistance levels will refine your strategy. Avoid common pitfalls and continuously backtest your approach to adapt to market changes. For comprehensive insights and support, consider leveraging resources from DayTradingBusiness to elevate your trading journey.

Learn about How to Use Technical Analysis for Options Day Trading