Did you know that 90% of day traders lose money, making it the ultimate high-stakes game of poker? But fear not! In this article, we’ll uncover simple day trading strategies designed for quick gains, perfect for beginners looking to navigate the fast-paced world of trading. From identifying profitable opportunities to understanding essential indicators, we’ll guide you through setting up a solid day trading plan and managing risk effectively. Learn about the best timeframes, the impact of news events, and the tools necessary for success. With insights into psychological aspects, common mistakes to avoid, and tips for maintaining discipline, you’ll be well-equipped to create a winning routine. Let DayTradingBusiness help you turn the odds in your favor!

What are the best simple day trading strategies for beginners?

1. Scalping: Make quick trades to profit from small price changes. Focus on high-volume stocks and execute multiple trades throughout the day.

2. Momentum Trading: Identify stocks moving significantly in one direction on high volume. Buy when the price rises and sell at the peak.

3. Breakout Trading: Look for stocks that break above resistance or below support levels. Enter the trade as the price breaks out to capture rapid gains.

4. Reversal Trading: Watch for stocks that show signs of reversing after a trend. Use indicators like RSI or MACD to time your entry.

5. News-Based Trading: Trade based on news releases or earnings reports. Stocks often react sharply to news, providing opportunities for quick profits.

6. Range Trading: Identify stocks that trade within a consistent range. Buy at support and sell at resistance, capitalizing on price fluctuations.

7. Moving Averages: Use short-term moving averages (like the 5-day or 10-day) to identify trends. Buy when the price crosses above the average and sell when it crosses below.

These strategies offer a straightforward approach for beginners looking to make quick gains in day trading.

How can I identify profitable day trading opportunities?

To identify profitable day trading opportunities, focus on these strategies:

1. Momentum Trading: Look for stocks with strong upward or downward momentum. Use scanners to find stocks with high volume and price movement.

2. Technical Analysis: Analyze charts for patterns and indicators like moving averages, RSI, and MACD. Identify support and resistance levels to make entry and exit decisions.

3. News Catalysts: Monitor financial news and earnings reports. News can create volatility, presenting quick trading opportunities.

4. Pre-Market and After-Hours Trading: Check pre-market and after-hours price movements. These can signal potential trends for the day.

5. Sector Movement: Watch sectors that are moving, as stocks within strong sectors often follow the trend.

6. Risk Management: Set stop-loss and take-profit levels to manage risk effectively. This protects your capital while allowing for quick gains.

By combining these strategies, you can spot and act on day trading opportunities more effectively.

What indicators should I use for day trading?

For day trading, focus on these key indicators:

1. Moving Averages: Use the 50-day and 200-day moving averages to identify trends.

2. Relative Strength Index (RSI): Look for overbought or oversold conditions, typically above 70 or below 30.

3. MACD (Moving Average Convergence Divergence): This helps identify momentum and potential reversals.

4. Volume: High trading volume can confirm trends; low volume may indicate weakness.

5. Bollinger Bands: These show price volatility and potential overbought or oversold conditions.

Combine these indicators to enhance your trading strategy and make informed decisions for quick gains.

How do I set up a day trading plan for quick gains?

1. Define Your Goals: Decide on your profit targets and risk tolerance. Aim for specific, achievable gains.

2. Choose a Trading Style: Focus on scalping for quick profits or momentum trading to capitalize on price shifts.

3. Select Your Market: Pick stocks, options, or forex that have high volatility and liquidity for better trading opportunities.

4. Develop a Strategy: Use technical analysis with indicators like moving averages or RSI to identify entry and exit points.

5. Set Risk Management Rules: Limit losses with stop-loss orders and only risk a small percentage of your capital on each trade.

6. Create a Daily Routine: Start with pre-market analysis, monitor news and trends, and establish a trading schedule.

7. Keep Records: Track your trades, analyze performance, and adjust your strategies based on what works.

8. Stay Disciplined: Stick to your plan, avoid emotional trading, and be prepared to adapt as market conditions change.

What timeframes are best for day trading?

The best timeframes for day trading are typically 1-minute, 5-minute, and 15-minute charts. These allow traders to capture quick price movements and make rapid trades. The 1-minute chart is great for scalping, while the 5 and 15-minute charts provide a balance between speed and trend analysis. Focus on high liquidity stocks to maximize quick gains.

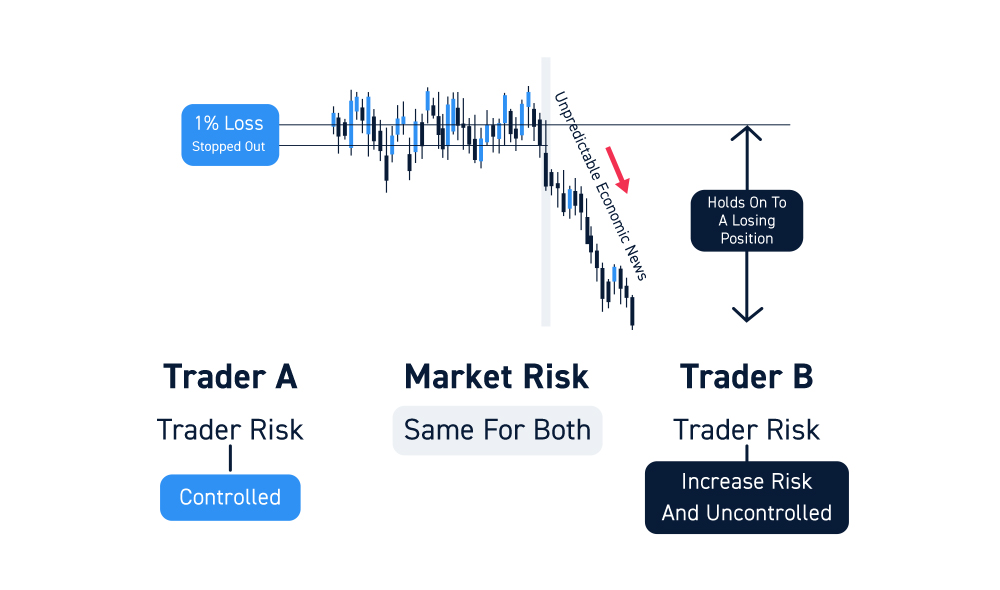

How do I manage risk in day trading?

To manage risk in day trading, use these strategies:

1. Set a Stop-Loss Order: Determine a price point to automatically sell if a trade goes against you, limiting your losses.

2. Position Sizing: Invest only a small percentage of your capital in each trade, typically 1-2%, to minimize risk exposure.

3. Diversify Trades: Avoid putting all your funds into one stock. Spread your investments across multiple assets to reduce risk.

4. Stick to a Trading Plan: Define entry and exit points, and stick to your plan to avoid emotional decision-making.

5. Use Technical Analysis: Analyze charts and indicators to make informed decisions and identify potential risks before entering a trade.

6. Monitor Market Conditions: Stay updated on market news and trends that could impact your trades, adjusting your strategy accordingly.

7. Review and Adapt: Regularly assess your trading performance and strategies. Learn from losses to improve your approach.

Implementing these strategies can help you manage risk effectively in day trading.

What are the key psychological aspects of day trading?

The key psychological aspects of day trading include discipline, emotional control, and risk management. Traders must stick to their strategies, avoiding impulsive decisions driven by fear or greed. Maintaining focus is crucial; distractions can lead to costly mistakes. Additionally, managing stress levels helps in making rational choices during volatile market conditions. Developing a mindset for accepting losses and learning from them is essential for long-term success.

How can I effectively use stop-loss orders in day trading?

To effectively use stop-loss orders in day trading, first determine your risk tolerance and set a stop-loss level based on a percentage of your entry price or a specific dollar amount. Place the stop-loss order just below a recent support level to give your trade some room to fluctuate. Adjust your stop-loss to break even once the trade moves favorably. Use trailing stops to lock in profits as the price rises. Regularly review and adjust your stop-loss orders based on market conditions and volatility to minimize potential losses.

What stocks are best for day trading today?

The best stocks for day trading today are those with high volatility and significant trading volume. Look for stocks like Tesla (TSLA), Amazon (AMZN), and Nvidia (NVDA), as they often see rapid price movements and liquidity. Additionally, keep an eye on news-driven stocks or earnings reports, as these can create quick trading opportunities. Always check pre-market activity for stocks showing strong momentum before the market opens.

How do news events impact day trading strategies?

News events significantly impact day trading strategies by causing volatility and rapid price movements. Traders often react to earnings reports, economic data releases, or geopolitical developments. For instance, positive earnings can lead to quick buying opportunities, while negative news may prompt swift selling.

To capitalize on this, day traders can implement strategies like news-based trading, where they enter positions immediately after major news breaks. They may also use technical analysis to identify entry and exit points based on price movements triggered by the news. Keeping an economic calendar and monitoring news feeds are essential for making informed decisions.

Learn about How to Stay Updated on Crypto Market News for Day Trading

What tools and platforms are essential for day trading?

Essential tools and platforms for day trading include:

1. Brokerage Account: Choose a broker with low fees, fast execution, and a user-friendly platform, like TD Ameritrade or Interactive Brokers.

2. Trading Software: Use platforms like Thinkorswim or TradingView for advanced charting and technical analysis.

3. News Feed: Stay updated with real-time news sources like Bloomberg or Reuters to react quickly to market changes.

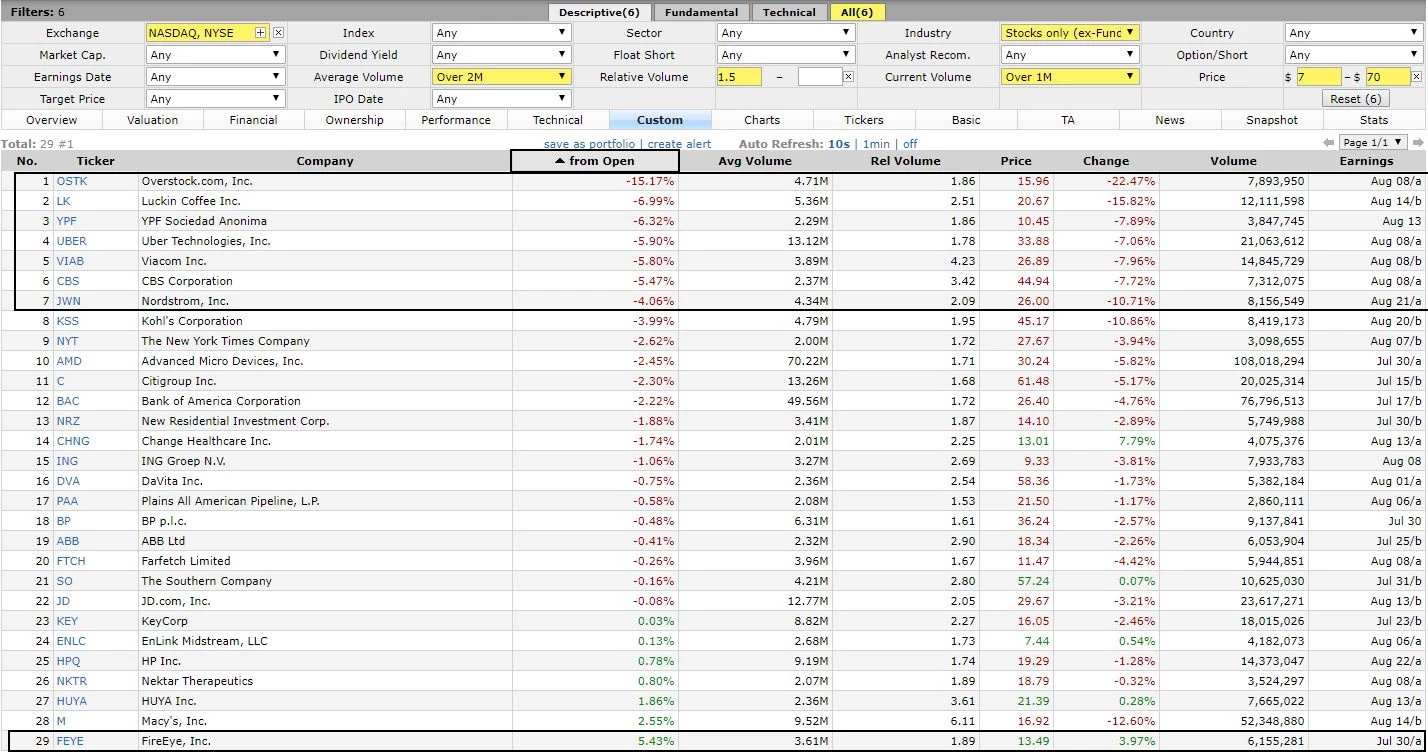

4. Stock Scanner: Utilize scanners like Finviz or Trade Ideas to identify potential stocks based on volume, volatility, and price movements.

5. Risk Management Tools: Implement stop-loss orders and position sizing calculators to manage risk effectively.

6. Mobile Trading App: Have a reliable mobile app to trade on the go, such as Robinhood or E*TRADE.

These tools enhance your ability to make quick, informed decisions for day trading.

What are the best simple day trading strategies for beginners to achieve quick gains?

Simple day trading strategies for quick gains include:

1. **Scalping** – Making multiple trades throughout the day to profit from small price changes.

2. **Momentum Trading** – Buying stocks that are trending upward and selling them once momentum slows.

3. **Breakout Trading** – Entering trades when a stock price breaks above resistance or below support.

4. **Reversal Trading** – Identifying potential reversals in price trends and trading against the current trend.

5. **News-Based Trading** – Capitalizing on stock price movements driven by news events or earnings reports.

These strategies can help beginners achieve quick gains in day trading.

Learn more about: Day Trading Strategies for Beginners

Learn about Best Day Trading Strategies for Volatile Markets

How can I create a winning day trading routine?

To create a winning day trading routine, start by setting a clear goal for daily profits. Choose a few stocks or ETFs to focus on, ensuring they have high volatility and volume.

Begin each day with a pre-market analysis to identify potential trades based on news and technical indicators. Use a trading journal to track your trades, noting what works and what doesn’t.

Establish strict entry and exit rules to minimize emotional decisions. Set stop-loss orders to protect your capital. Take breaks to avoid burnout and reassess strategies if you hit losing streaks.

End your day with a review of your performance, analyzing successes and mistakes to refine your approach. Consistency and discipline are key to quick gains in day trading.

Learn about How to Create a Day Trading Checklist

What are common mistakes to avoid in day trading?

1. Overtrading: Avoid taking too many trades; focus on quality over quantity.

2. Lack of a Trading Plan: Always have a clear strategy before entering a trade.

3. Ignoring Risk Management: Set stop-loss orders to protect your capital.

4. Emotional Trading: Don’t let fear or greed dictate your decisions.

5. Neglecting Market Research: Stay informed about market trends and news that could impact your trades.

6. Failing to Learn from Mistakes: Review your trades to understand what worked and what didn’t.

7. Trading Without a Strategy: Stick to simple day trading strategies you’ve tested and trust.

8. Chasing Losses: Avoid the urge to recover losses by making impulsive trades.

9. Overleveraging: Don’t risk too much of your capital on a single trade.

10. Ignoring Fees and Commissions: Factor in costs before placing trades to ensure profitability.

Learn about Common Mistakes in Day Trading Scalping and How to Avoid Them

How do I analyze chart patterns for day trading?

To analyze chart patterns for day trading, start by identifying key patterns like flags, pennants, head and shoulders, and double tops/bottoms. Use candlestick formations to gauge market sentiment.

Focus on support and resistance levels to determine entry and exit points. Combine pattern analysis with volume indicators to confirm trends.

Set up your charts with time frames that suit day trading, typically 1-minute to 15-minute intervals. Always have a risk management strategy in place to protect your capital. Regularly practice and refine your analysis skills.

What are the differences between day trading and swing trading?

Day trading involves buying and selling securities within the same trading day, aiming for quick profits from small price movements. Swing trading, on the other hand, holds positions for several days or weeks to capitalize on expected price shifts. Day traders rely on technical analysis and real-time data, while swing traders look for broader market trends and patterns. Day trading requires more time and attention, while swing trading allows for a more flexible schedule.

Learn about Differences Between Forex and Other Day Trading Markets

How can I stay disciplined and focused while day trading?

To stay disciplined and focused while day trading, establish a clear trading plan with specific entry and exit points. Set realistic daily goals and stick to them. Use a trading journal to track your trades and emotions, helping you learn from mistakes. Limit distractions by creating a dedicated trading environment. Use timers to enforce breaks and maintain concentration. Finally, practice risk management by never risking more than a small percentage of your capital on a single trade.

Learn about How to Stay Disciplined in Futures Day Trading

Conclusion about Simple Day Trading Strategies for Quick Gains

In conclusion, mastering simple day trading strategies can lead to quick gains for beginners. By identifying profitable opportunities, utilizing key indicators, and managing risk effectively, traders can enhance their chances of success. Establishing a solid day trading plan, staying informed on news events, and avoiding common pitfalls are crucial steps. For comprehensive support and resources tailored to your trading journey, explore the insights offered by DayTradingBusiness.