Did you know that the average day trader spends more time analyzing charts than a chef spends perfecting their soufflé? In the fast-paced world of day trading, having a solid strategy is essential for success. This article from DayTradingBusiness dives into the top day trading strategies to maximize profits, covering everything from beginner tactics to advanced techniques like scalping and momentum trading. We’ll explore crucial topics such as essential technical indicators, setting up a profitable day trading plan, and the importance of risk management. Additionally, we’ll discuss how to identify the best stocks, navigate market news, and avoid common pitfalls. Equip yourself with the right tools and resources to enhance your trading performance and adapt to ever-changing market conditions. Dive in to discover how to sharpen your trading skills and boost your profitability!

What are the best day trading strategies for beginners?

1. Scalping: Make quick trades for small profits by taking advantage of small price changes. Focus on high liquidity stocks.

2. Momentum Trading: Buy stocks that are trending up and sell when they show signs of reversal. Use volume and news to identify trends.

3. Breakout Trading: Enter a trade when the price breaks through established support or resistance levels. Look for strong volume to confirm breakouts.

4. Reversal Trading: Identify potential trend reversals using indicators like RSI or MACD. Buy when the stock shows signs of turning around after a downtrend.

5. News-Based Trading: Capitalize on stock price movements triggered by news events. Be quick to react to earnings reports or major announcements.

6. Technical Analysis: Use charts and indicators to identify patterns and make informed decisions. Familiarize yourself with moving averages, Bollinger Bands, and Fibonacci retracement.

Choose one or two strategies to start with, and practice with demo accounts before trading with real money.

How can I maximize profits with scalping in day trading?

To maximize profits with scalping in day trading, focus on these strategies:

1. Choose Liquid Stocks: Target stocks with high trading volume for quick entry and exit.

2. Use Technical Analysis: Rely on charts and indicators like moving averages and RSI to identify trends.

3. Set Tight Stop-Loss Orders: Protect your capital by minimizing losses with strict stop-loss levels.

4. Trade During High Volatility: Focus on times when the market is most active, such as market openings.

5. Limit Your Trades: Execute a few high-quality trades instead of many low-quality ones to maintain focus.

6. Practice Discipline: Stick to your strategy and avoid emotional trading decisions.

7. Leverage Technology: Use fast trading platforms and tools to execute trades quickly.

By implementing these strategies, you can enhance your scalping effectiveness and boost your profits.

What is swing trading and how does it differ from day trading?

Swing trading involves holding positions for several days to weeks to capitalize on price movements, while day trading entails buying and selling within the same day, closing all positions before the market closes. Swing traders focus on medium-term trends, whereas day traders aim for quick, small profits on daily price fluctuations.

Which technical indicators are essential for day trading success?

Key technical indicators for day trading success include:

1. Moving Averages (MA): Use short-term MAs (like the 10-day and 20-day) to identify trends.

2. Relative Strength Index (RSI): Helps determine overbought or oversold conditions.

3. MACD (Moving Average Convergence Divergence): Signals potential buy or sell opportunities through crossovers.

4. Bollinger Bands: Indicates volatility and potential price reversals.

5. Volume: Confirms trends; higher volume often indicates stronger moves.

Incorporating these indicators can enhance your day trading strategies and maximize profits.

How do I set up a day trading plan to enhance profitability?

To set up a day trading plan that enhances profitability, focus on these key strategies:

1. Define Your Goals: Determine your profit targets and risk tolerance. Aim for specific daily or weekly profits.

2. Choose Your Market: Select stocks, ETFs, or forex pairs that you understand. Stick to high liquidity assets for better execution.

3. Develop a Strategy: Use strategies like momentum trading, scalping, or reversal trading. Backtest your strategies to ensure viability.

4. Set Entry and Exit Points: Clearly define when to buy and sell. Use technical indicators like moving averages or RSI to guide your decisions.

5. Implement Risk Management: Set stop-loss orders to limit potential losses. Never risk more than 1-2% of your capital on a single trade.

6. Keep a Trading Journal: Document your trades, strategies, and outcomes. Analyze your performance to identify what works and what doesn’t.

7. Stay Informed: Follow market news and trends that impact your trading assets. Economic indicators can greatly affect market movements.

8. Practice Discipline: Stick to your plan and avoid emotional trading. Consistency is key to long-term profitability.

By following these strategies, you can create a structured day trading plan that maximizes your profit potential.

What role does risk management play in day trading strategies?

Risk management is crucial in day trading strategies because it helps protect your capital and minimize losses. Effective risk management involves setting stop-loss orders to limit potential losses, determining position sizes based on account size and risk tolerance, and diversifying trades to avoid overexposure. By controlling risk, you can stay in the market longer, make more informed decisions, and ultimately maximize profits.

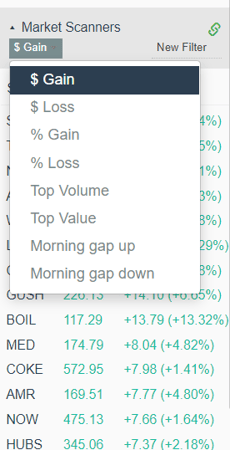

How can I identify the best stocks for day trading?

To identify the best stocks for day trading, focus on high volatility stocks with significant price movements throughout the day. Look for stocks with large trading volumes, as they indicate liquidity and ease of buying and selling. Use technical analysis tools like moving averages, RSI, and MACD to spot entry and exit points. Monitor news and earnings reports for catalysts that can drive price changes. Finally, consider sector trends and market conditions to align your trades with broader movements.

What are the most effective chart patterns for day traders?

The most effective chart patterns for day traders include:

1. Head and Shoulders: Indicates trend reversals. Look for a peak (head) between two lower peaks (shoulders).

2. Double Top and Bottom: Signals potential reversals. A double top suggests a bearish reversal; a double bottom indicates a bullish reversal.

3. Flags and Pennants: These continuation patterns show brief consolidations before the trend resumes. Flags are rectangular; pennants are triangular.

4. Triangles: Ascending, descending, and symmetrical triangles reflect market consolidation. Breakouts often follow these patterns.

5. Cup and Handle: This bullish pattern shows a rounded bottom followed by a consolidation phase (the handle) before a breakout.

Focus on volume and price action to confirm these patterns for better trading decisions.

How do news events impact day trading strategies?

News events can significantly impact day trading strategies by causing price volatility and influencing market sentiment. Traders often use strategies like news trading, where they capitalize on market reactions immediately following major announcements. For instance, earnings reports, economic data releases, or geopolitical events can lead to rapid price movements.

To maximize profits, day traders might employ techniques such as:

1. Scalping: Quickly entering and exiting trades based on news spikes.

2. Momentum Trading: Following the trend established by news releases.

3. Range Trading: Identifying support and resistance levels after a news event to make trades.

Staying informed and reacting swiftly to news can enhance a trader's ability to profit from these fluctuations.

What are the psychological aspects of day trading to consider?

The psychological aspects of day trading include emotional discipline, risk tolerance, and decision-making under pressure. Traders often face fear and greed, which can lead to impulsive decisions. Maintaining a trading plan helps counteract emotions. It's crucial to manage stress and stay focused, as distractions can impact performance. Additionally, self-awareness of your trading biases can improve outcomes. Building resilience against losses and staying patient during drawdowns are key to long-term success.

Learn about Psychological Aspects of Day Trading Futures

How can I use momentum trading to boost my day trading profits?

To use momentum trading for boosting your day trading profits, focus on these key steps:

1. Identify Strong Trends: Look for stocks with significant price movements and high volume. Use technical indicators like the Relative Strength Index (RSI) or moving averages to confirm momentum.

2. Entry Points: Enter trades when the price breaks above resistance or shows strong upward movement. Consider buying on pullbacks within an uptrend.

3. Set Targets and Stops: Define clear profit targets and stop-loss levels before entering a trade. This helps manage risk and lock in profits.

4. Monitor News and Events: Stay updated on news that could impact stock prices. Positive news can enhance momentum.

5. Be Quick: Execute trades swiftly to capitalize on short-term price movements. Use limit orders to enter at desired prices.

6. Exit Strategy: Have an exit plan, whether it’s a set profit target or trailing stop to capture gains as momentum shifts.

By focusing on these strategies, you can effectively harness momentum trading to enhance your day trading profits.

Learn about How to Identify Momentum Stocks for Day Trading

What are the best day trading strategies for beginners to maximize profits?

1. **Scalping**: Make quick trades for small profits on minor price changes.

2. **Momentum Trading**: Buy stocks trending upward and sell when momentum wanes.

3. **Breakout Trading**: Enter positions when a stock breaks above resistance or below support.

4. **Reversal Trading**: Identify and trade against the prevailing trend, anticipating a price reversal.

5. **News-Based Trading**: Trade based on news events impacting stock prices.

These top day trading strategies can help beginners maximize profits effectively.

Learn more about: Day Trading Strategies for Beginners

Learn about Best Day Trading Strategies for Volatile Markets

What are the advantages of using a day trading simulator?

Using a day trading simulator offers several advantages:

1. Risk-Free Learning: You can practice strategies without financial loss, allowing you to build skills and confidence.

2. Strategy Testing: Simulators let you test different day trading strategies in real market conditions, helping you identify what works best for you.

3. Emotional Control: They help you manage emotions like fear and greed in a no-stakes environment, essential for real trading success.

4. Performance Tracking: Many simulators provide analytics on your trades, letting you refine your approach and improve your decision-making.

5. Market Familiarity: You gain experience with market movements and trading platforms, making the transition to live trading smoother.

6. Customizable Scenarios: Simulators allow you to recreate specific market conditions and test your reactions, which is invaluable for preparation.

Using a simulator can significantly enhance your readiness and effectiveness as a day trader.

How do successful day traders manage their time during trading hours?

Successful day traders manage their time by following a structured routine that includes pre-market analysis, focused trading sessions, and post-trade reviews. They start by researching stocks and setting watchlists before the market opens. During trading hours, they prioritize high-volatility stocks, stick to their trading plan, and avoid distractions. Traders often set specific time limits for each trade to prevent overtrading and maintain discipline. After the market closes, they review their trades to analyze performance and refine strategies. This disciplined time management helps maximize profits and minimize losses.

Learn about How to Time Your Day Trading Entries and Exits

What are common mistakes to avoid in day trading?

Common mistakes to avoid in day trading include:

1. Lack of a Trading Plan: Entering trades without a clear strategy leads to impulsive decisions.

2. Overtrading: Taking too many positions increases transaction costs and emotional stress.

3. Ignoring Risk Management: Failing to set stop-loss orders can result in significant losses.

4. Chasing Losses: Trying to recover losses quickly often leads to even bigger losses.

5. Neglecting Market Research: Skipping analysis leaves traders unprepared for market movements.

6. Emotional Trading: Letting fear or greed dictate trades can derail your strategy.

7. Not Keeping a Trading Journal: Failing to track trades prevents learning from mistakes and successes.

8. Overconfidence: Believing you can beat the market consistently can lead to careless decisions.

Avoid these pitfalls to enhance your day trading strategy and maximize profits.

Learn about Common Mistakes in Day Trading Scalping and How to Avoid Them

How can I adapt my day trading strategies to changing market conditions?

To adapt your day trading strategies to changing market conditions, start by analyzing volatility. Increase your position sizes during high volatility and reduce them when the market is calm. Use technical indicators like moving averages to identify trend shifts and adjust your entry and exit points accordingly.

Stay informed about news and events that impact your assets—react swiftly to changes. Diversify your trades across different sectors to mitigate risks. Lastly, continuously review and refine your strategies based on performance metrics; be ready to pivot when necessary.

Learn about How to Find the Right Market for Day Trading

What tools and resources can help improve my day trading performance?

To improve your day trading performance, consider these tools and resources:

1. Trading Platforms: Use robust platforms like ThinkorSwim, MetaTrader, or TradeStation for real-time data and advanced charting.

2. Technical Analysis Tools: Leverage tools like TradingView for customizable charts and indicators to identify trends and patterns.

3. News Aggregators: Utilize services like Bloomberg or Reuters for timely market news that impacts stock prices.

4. Risk Management Software: Implement tools like Trade Ideas to set stop-loss orders and manage your risk effectively.

5. Educational Resources: Explore online courses, webinars, and trading communities on platforms like Udemy or Investopedia to enhance your strategies.

6. Simulation Tools: Practice with paper trading accounts to refine your strategies without financial risk.

7. Stock Screeners: Use screeners like Finviz or StockCharts to filter stocks based on specific criteria like volume and volatility.

8. Economic Calendars: Stay updated with economic events using calendars from Forex Factory or Investing.com to anticipate market movements.

Integrating these tools can significantly enhance your day trading results and help maximize profits.

Conclusion about Top Day Trading Strategies to Maximize Profits

In conclusion, mastering day trading requires a strategic approach that encompasses a variety of techniques, from scalping and swing trading to effective risk management and the use of key technical indicators. By understanding market dynamics, leveraging tools and resources, and adapting strategies to evolving conditions, traders can significantly enhance their profitability. Embracing the insights and guidance from DayTradingBusiness will further empower your journey towards successful day trading.